Hazardous Waste Fuel Blending Market Data, Compilation, and Analysis

EI Digest Quarterly – Hazardous Waste Fuel Blending Report

Overview

The EI Digest Quarterly, Fuel Blending Report, is a comprehensive report designed specifically for stakeholders in the fuel blending industry. This exclusive report provides an in-depth analysis of reported receipts of hazardous waste for fuel blending, delivering valuable insights into industry trends and performance indicators. With its meticulous data collection and rigorous quality assurance processes, the report ensures the accuracy and reliability of the information presented.

Each edition of the report features updated figures, tables, and charts that enable stakeholders to track and evaluate key metrics over time. The report includes detailed analyses of monthly reported receipts, quarterly comparisons, and year-to-date performance, allowing stakeholders to gain a comprehensive understanding of the prevailing trends and developments within the fuel blending sector.

Furthermore, the report highlights notable changes and fluctuations, empowering stakeholders to make well-informed strategic decisions based on the latest industry insights. Key features of the report include figures that provide visual representations of the data, facilitating the identification of significant patterns and anomalies. Additionally, tables offer detailed information on individual facilities and companies involved in hazardous waste fuel blending, enabling stakeholders to assess market players and their contributions to the industry.

The EI Digest Quarterly, Fuel Blending Report, is a valuable resource for stakeholders, such as industry professionals, investors, regulatory bodies, and researchers, seeking to stay abreast of the dynamic landscape of fuel blending. By leveraging the insights provided in the report, stakeholders can enhance their operational efficiency, identify growth opportunities, and make informed decisions that drive sustainable success in the fuel blending industry.

Stay ahead of the competition and make data-driven decisions with the EI Digest Quarterly Fuel Blending Report – an indispensable tool for navigating the complexities of the fuel blending landscape.

EI Digest provides comprehensive coverage of all 22 companies engaged in commercial fuel blending services in the United States RCRA hazardous waste fuel blending, USEPA management method code h061, is provided by 22 different companies in the United States. Veolia North America, Heritage Environmental Services, Harsco Corporation, Elementia, Grupo Tradebe Medio Ambient SL, Clean Harbors Environmental Services, Holcim Ltd, Circon Environmental, Pacific Resource Recovery, Chemical Solvents Inc., Reclaimed Energy, WRR Environmental Services, Republic Services, Demenno Kerdoon, Perma-Fix Environmental Services, Waste Management, Vopak Logistic Services, Drug & Laboratory Disposal, Crosby and Overton, Lonestar Ecology, Set Environmental, and Excel TSD.

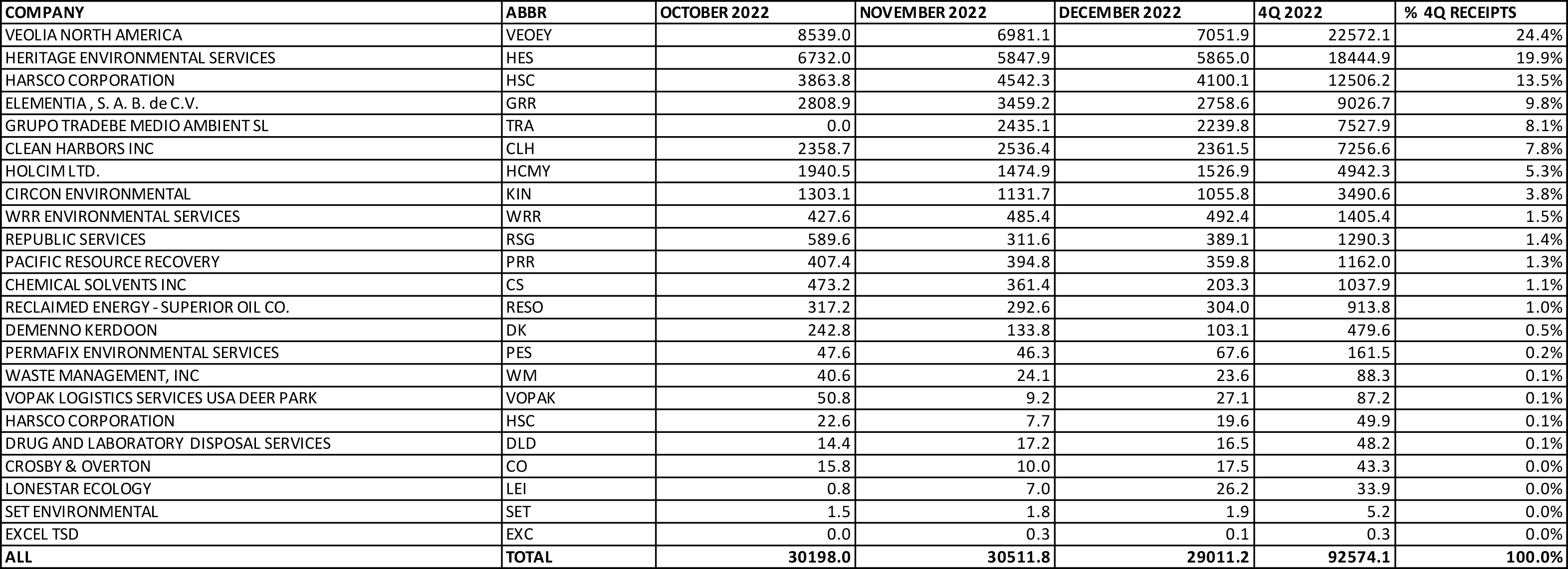

Each EI Digest quarterly – fuel blending report compiles the latest receipts for all 22 companies. The compiled receipts inform sales managers, strategists, and stakeholders as to how the market leaders did in the most current quarter for which data is available.

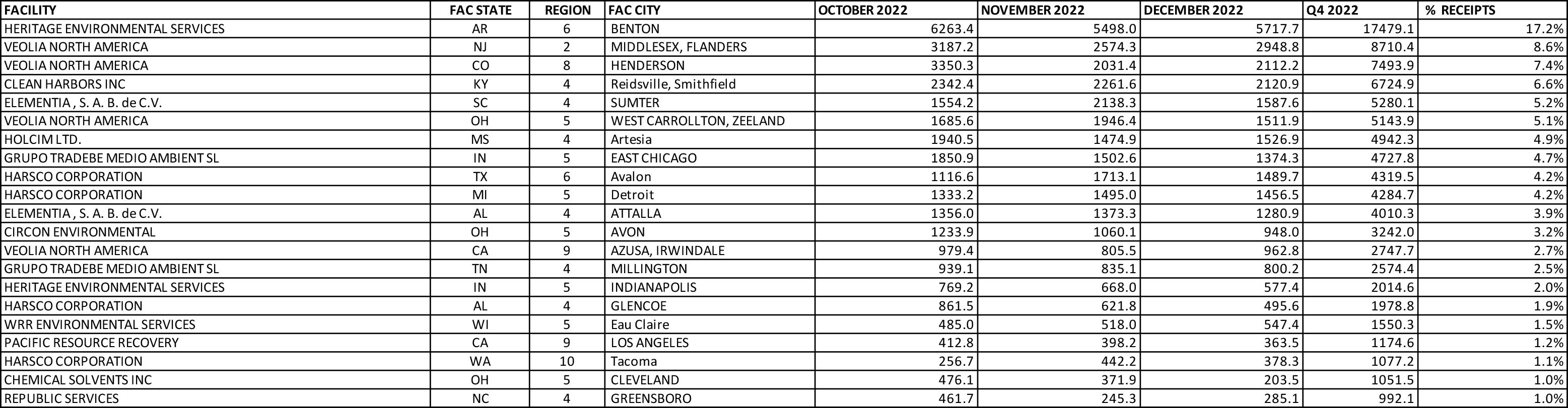

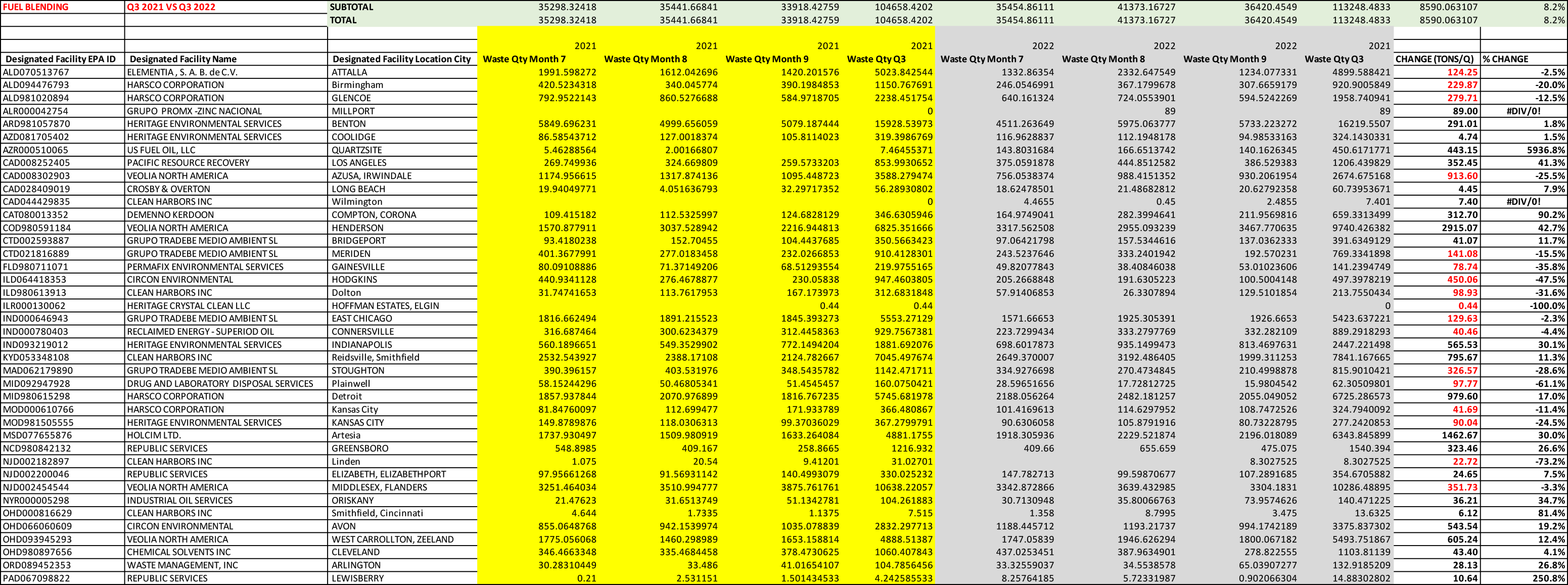

The EI Digest organizes the amount of waste received by all 22 companies into monthly and quarterly tables that enable company comparisons by investors, market strategists, sales managers, and other stakeholders. The monthly statistics enable all to determine if any company experienced disruptions in their waste receivables.

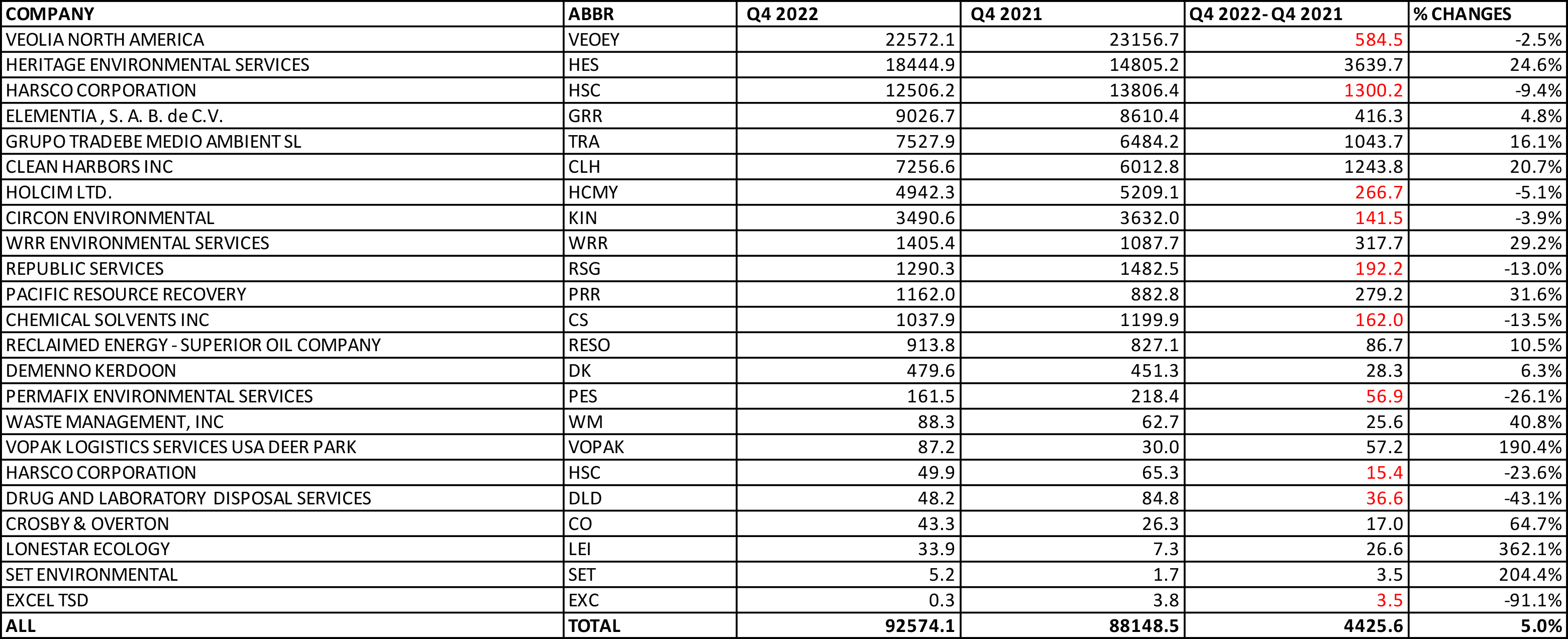

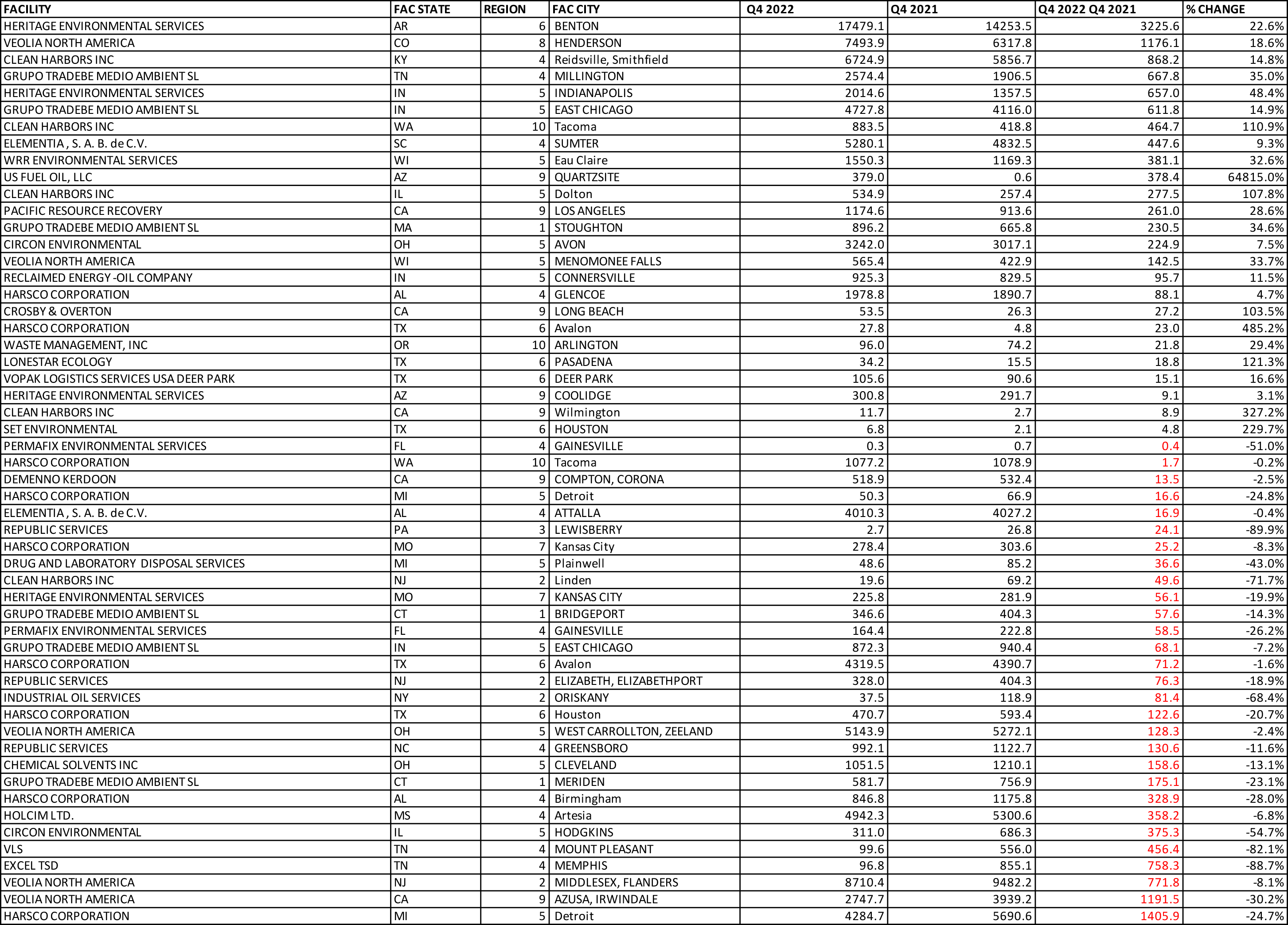

Every EI Digest provides how the most recent quarter of company waste receipts compared to the same quarter in the previous year. Investors, market strategists, and other stakeholders can utilize the quarter-to-quarter comparison of each company’s reported receipts to examine each company’s performance compared to its competitors.

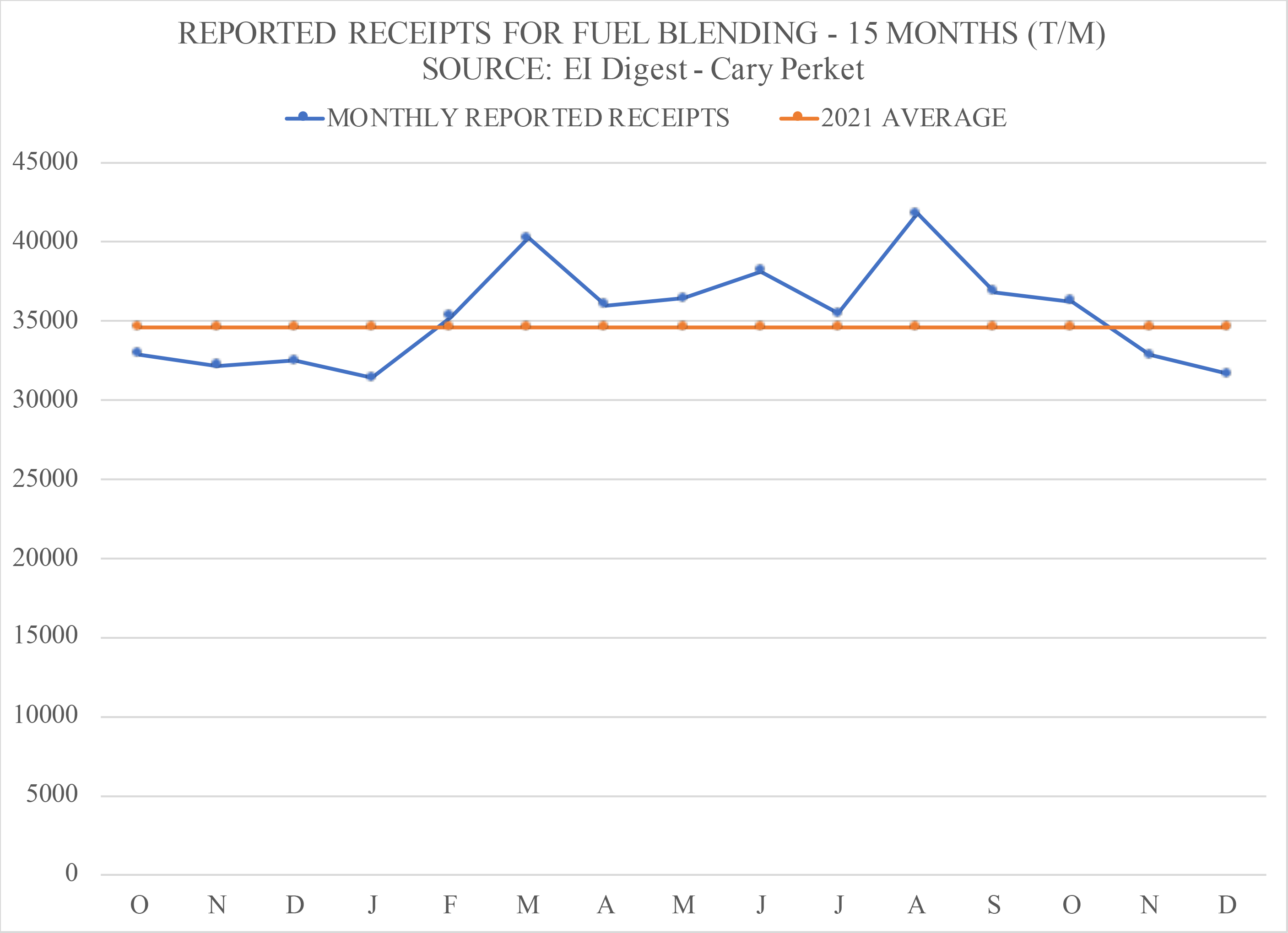

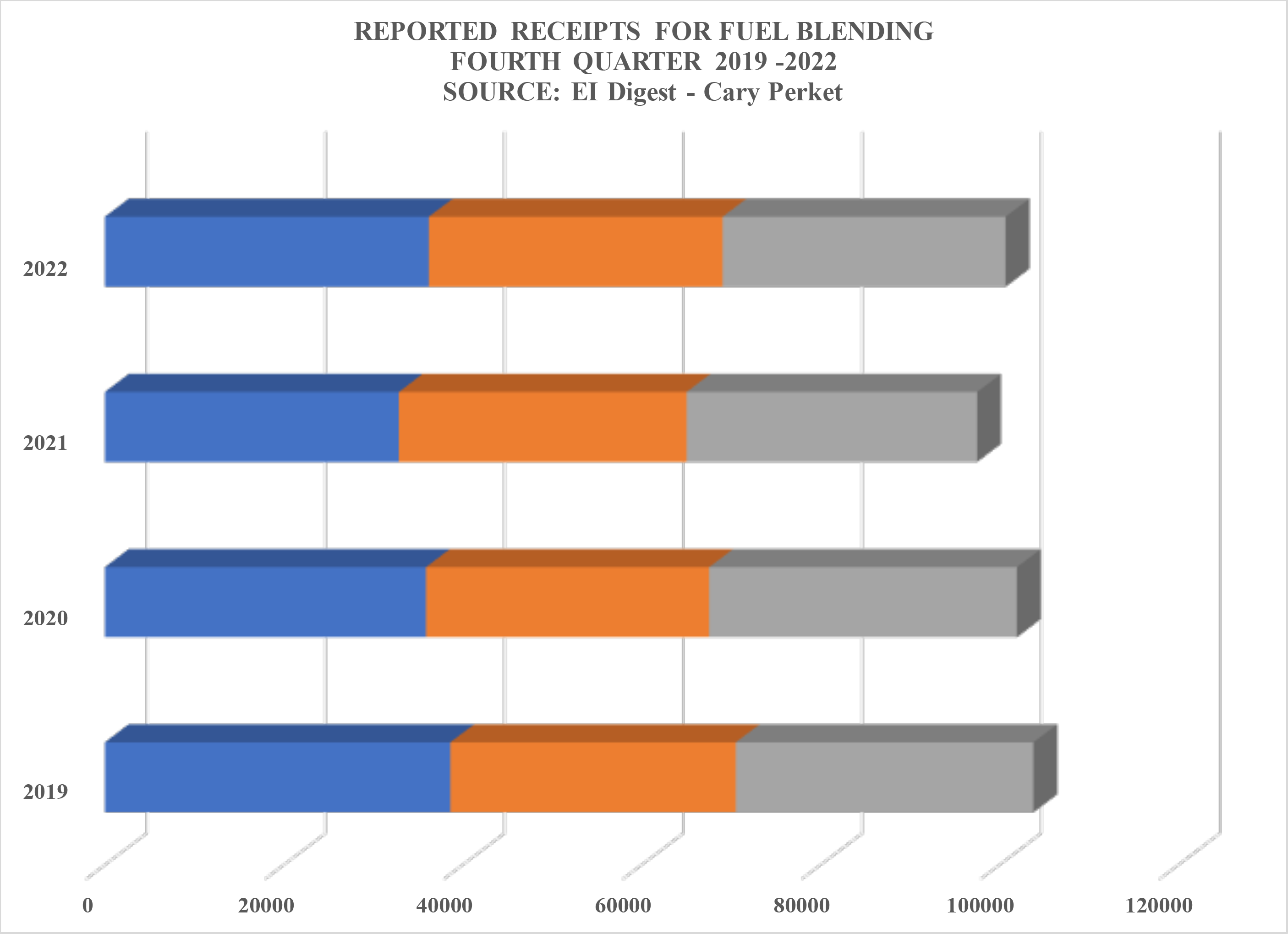

A 15-month history of the overall national receipts for hazardous waste fuel blending keeps clients aware of any seasonal decreases and/or decreases that might be expected based on recent past market behavior. Investors, sales managers, and stakeholders can use this knowledge to create their market expectations.

The EI Digest has invested in identifying and correcting past misreporting to enable each EI Digest to provide a comparison of the most recent quarter to multiple years of past market performance. This key comparison of current and past market performance provides investors, market strategists, sales managers, and other stakeholders with a historical basis to judge recent performance.

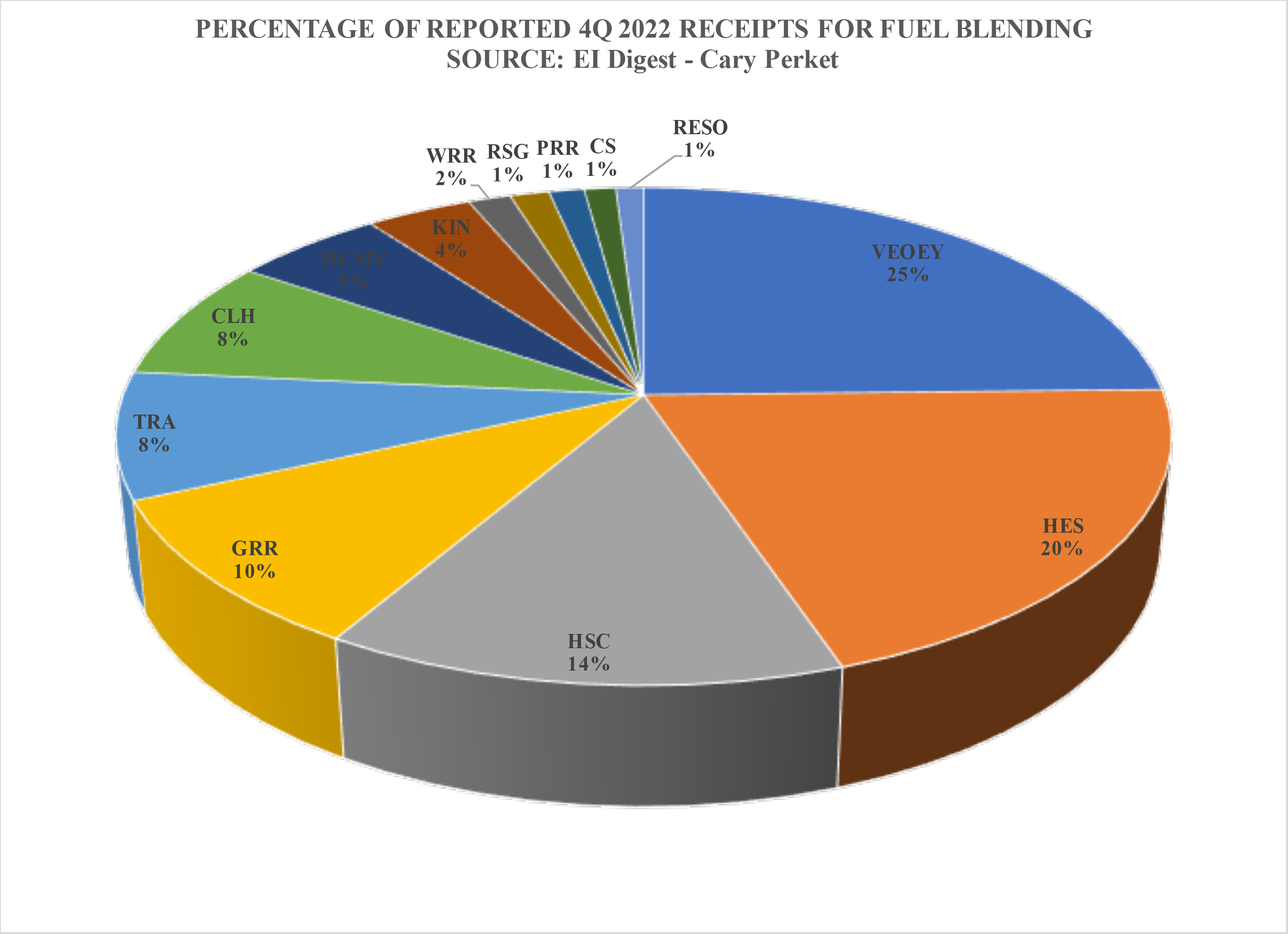

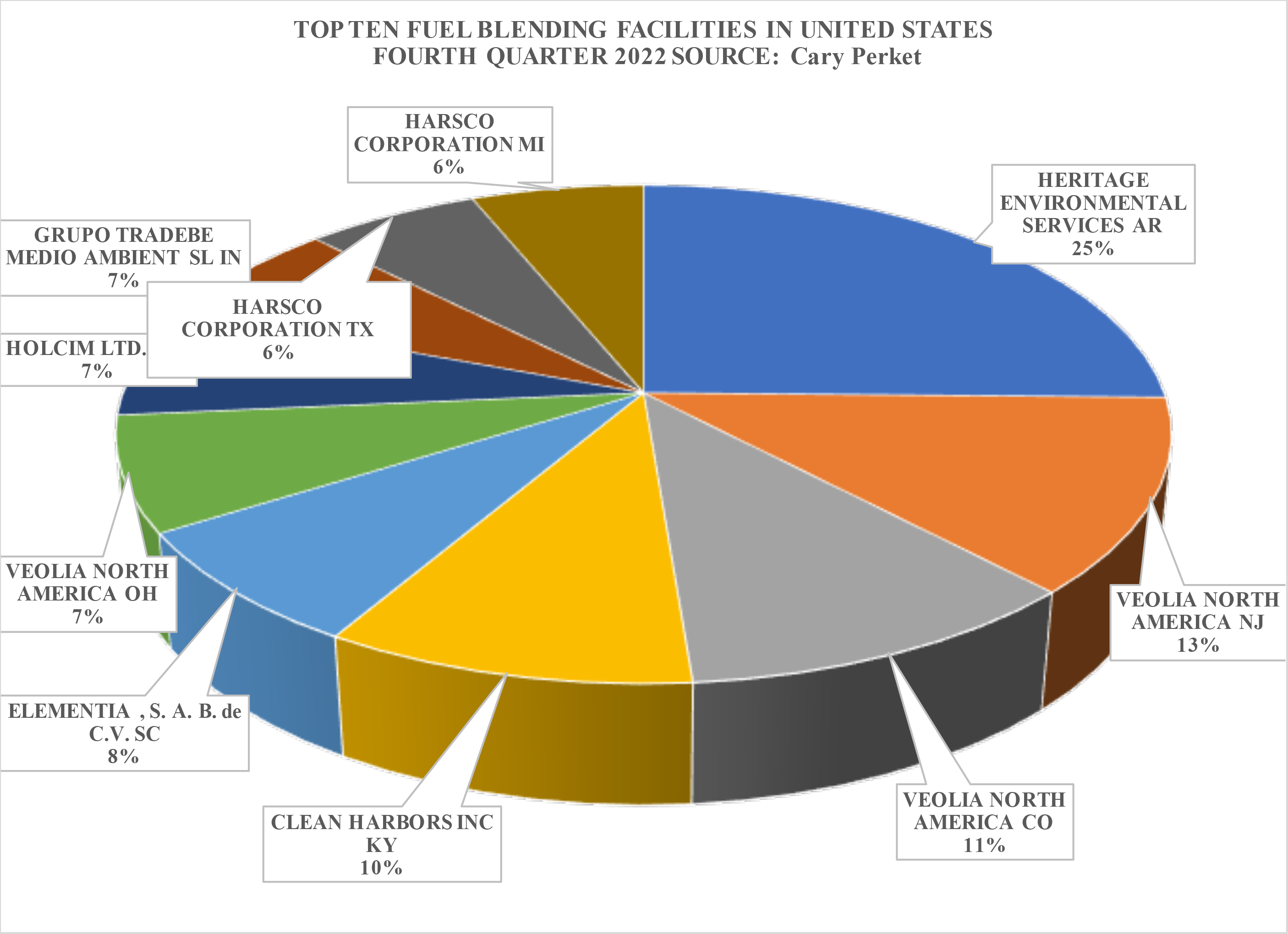

Each EI Digest includes the reported receipts of all 22 company’s individual facilities. The largest facilities are included in a pie chart that enables decision-makers, company management, investors, and stakeholders to quickly assess the leading fuel blending facilities’ market share in the most recent quarter.

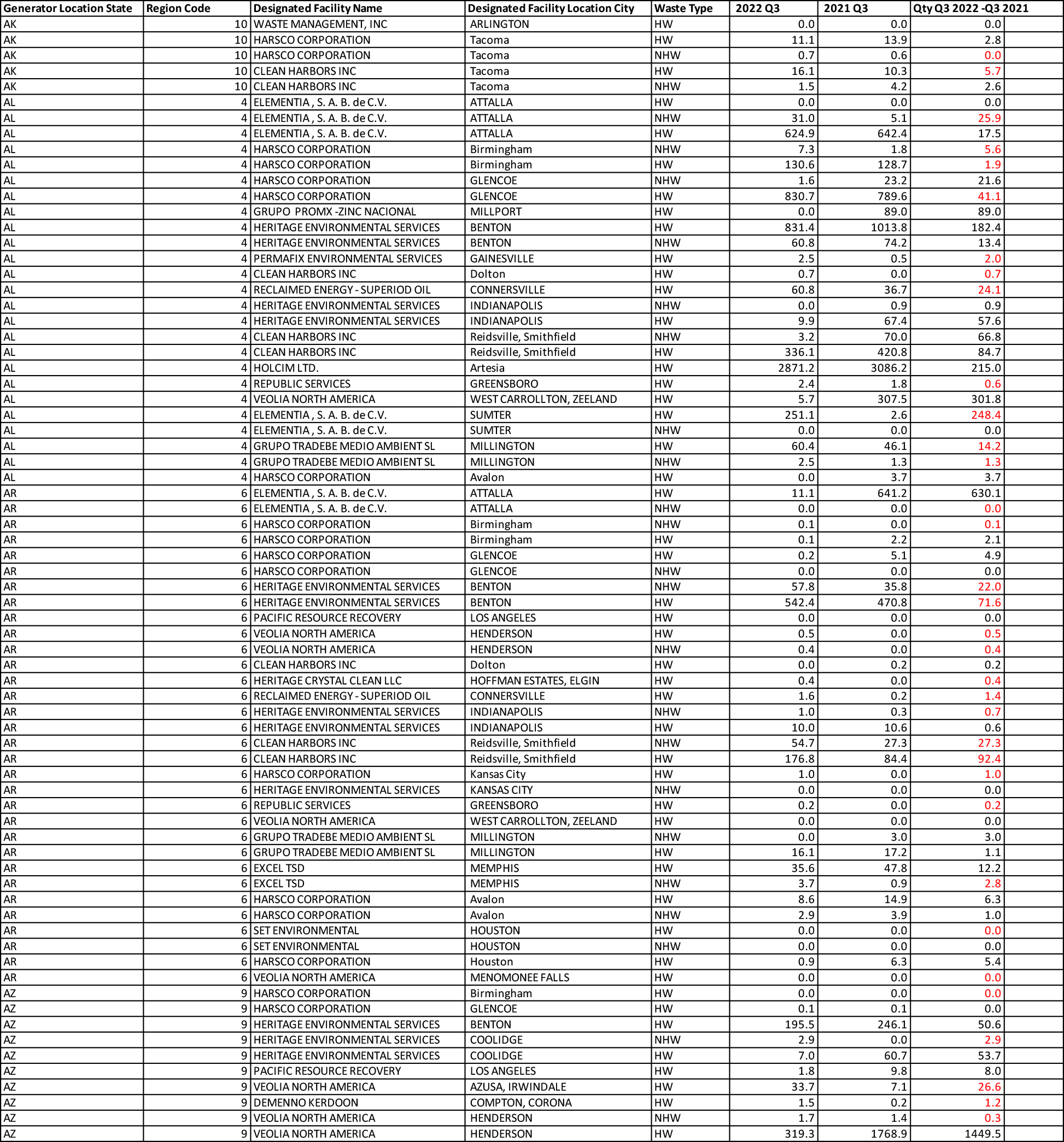

Each EI Digest quarterly report provides a table with the most recently reported three months’ receipts for all fuel blending facilities. The monthly reporting is compiled into a quarterly total that is utilized to rank each facility’s recent quarterly receipts on the basis of national market share for the quarter.

Each EI Digest quarterly provides a comparison of the most recent facility quarterly receipts to the previous year. This comparison is particularly useful in helping analysts, investors, and market strategists determine the extent to which individual facilities are reporting decreases and increases in the marketplace. The number of facilities reporting increases and decreases is an indicator of whether overall market change is taking place.

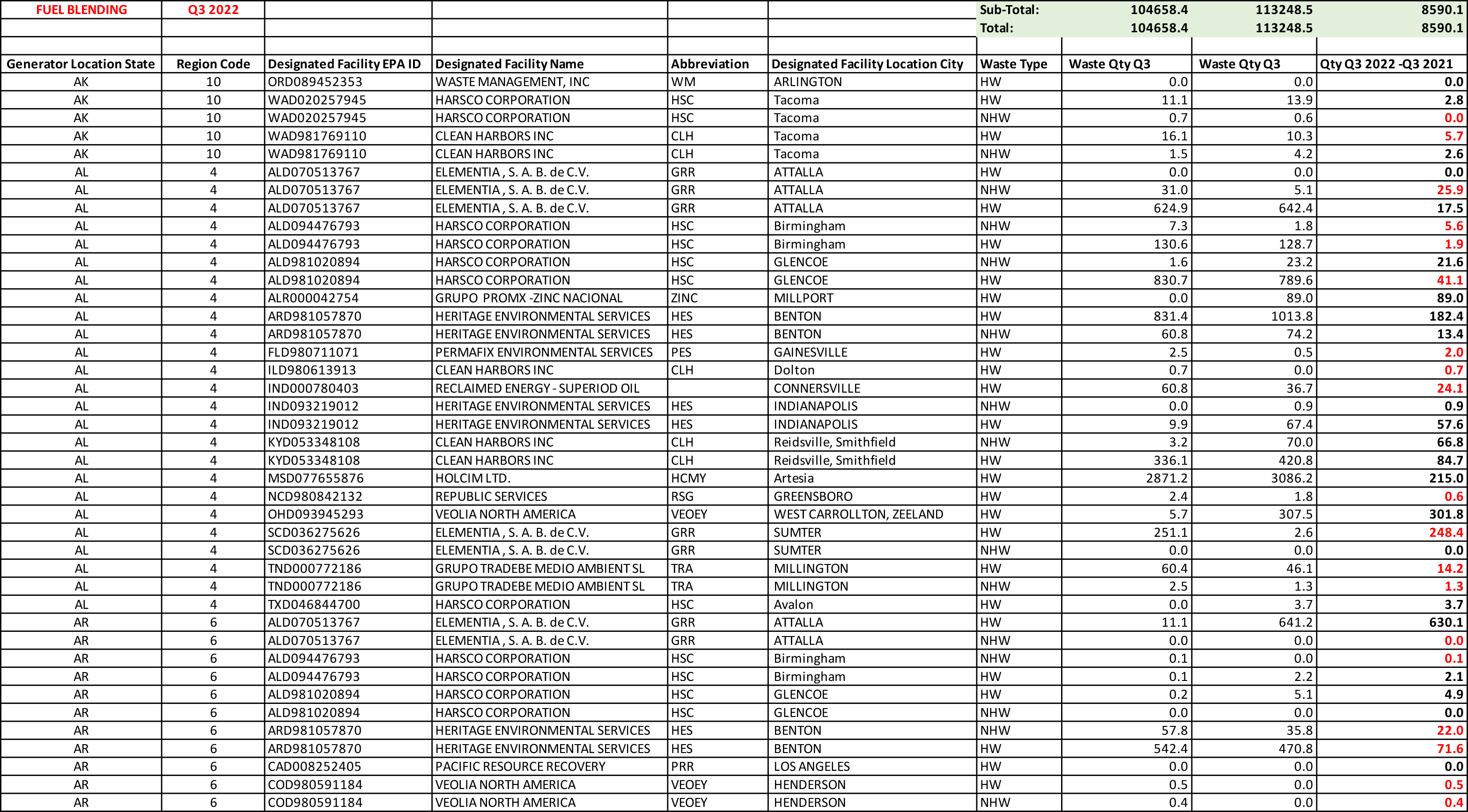

The EI Digest quarterly reports enable assessment of market changes by providing the reported quarterly receipts from each state for the most current quarter and the same quarter in the previous year. These tables enable interested parties to determine if significant changes are happening at the state level. Obviously, extensive decreases or decreases amongst the states would be an indicator of major market change occurring.

Fuel Blending worksheet I – facility (optional) enables clients to pursue more in-depth, custom analysis of the market.

The Microsoft Excel worksheet is designed to enable sorting and summation for individual facilities, groups of facilities, and/or companies. A key feature is the amount of RCRA hazardous and non-hazardous are itemized.

Fuel Blending worksheet II – state provides the amount of each waste type reported received by each facility.

The worksheet empowers the user to examine which facilities (& companies) are receiving waste from each state. It further enables the user to examine current market share based on the most recent quarter and to examine changes in market share over the same quarter in the previous year.

Fuel Blending worksheet I – facility (optional) enables clients to pursue more in-depth, custom analysis of the market.

The Microsoft Excel worksheet is designed to enable sorting and summation for individual facilities, groups of facilities, and/or companies. A key feature is the amount of RCRA hazardous and non-hazardous are itemized.

Fuel Blending worksheet II – state provides the amount of each waste type reported received by each facility.

The worksheet empowers the user to examine which facilities (& companies) are receiving waste from each state. It further enables the user to examine current market share based on the most recent quarter and to examine changes in market share over the same quarter in the previous year.