Photo courtesy of: Giant Resource Recovery

Hazardous Waste Energy Recovery Market Data, Compilation, & Analysis

EI Digest Quarterly – Hazardous Waste Energy Recovery Report

Overview

The EI Digest Quarterly Energy Recovery Report is a professional and comprehensive publication that provides stakeholders in the energy recovery sector with valuable insights and analysis on reported receipts for energy recovery. Published every quarter, this report offers comparative data from previous years to facilitate a comprehensive understanding of industry trends.

The report includes a range of figures and tables that present the data in a clear and informative manner. These visual representations allow stakeholders to track seasonal variations, identify peak months for energy recovery, and analyze the proportion of hazardous waste within reported receipts. By examining year-on-year changes and evaluating long-term patterns, stakeholders can make informed decisions and evaluate the progress of their energy recovery initiatives.

In addition to the figures and tables, the report utilizes expert perspectives from industry specialists, providing valuable insights and analysis on the implications of the reported receipts. These perspectives offer stakeholders a deeper understanding of waste management practices, transportation services, and market dynamics, enabling them to make informed choices and optimize their energy recovery strategies.

The EI Digest Quarterly Energy Recovery Report is a vital resource for stakeholders interested in staying abreast of the latest developments in the energy recovery sector. Regular updates and timely information ensure that subscribers have access to the most current and accurate data available. Whether analyzing performance, forecasting future trends, or making strategic decisions, this report serves as an indispensable tool for professionals in the energy recovery industry. EI Digest covers all companies providing RCRA commercial hazardous waste energy recovery in the United States.

Commercial energy recovery facilities are often referred to as commercial boilers and industrial furnaces (“BIFs”). The companies include Buzzi Unicem, CRH Inc (a.k.a. Ash Grove Cement), Elementia S.A.B. de C.V. (a.k.a. Giant Resource Recovery), Environmental Enterprises, Grupo Tradebe Medio Ambient SL (a.k.a. Norlite), Heidelberg Cement, Holcim Inc. (a.k.a. Geocycle, LaFarge, Systech Inc, Perma-Fix Environmental Services, PQ Corporation, Summit Materials (a.k.a. Continental Cement and Green America Recycling) and Tulsa Cement LLC.

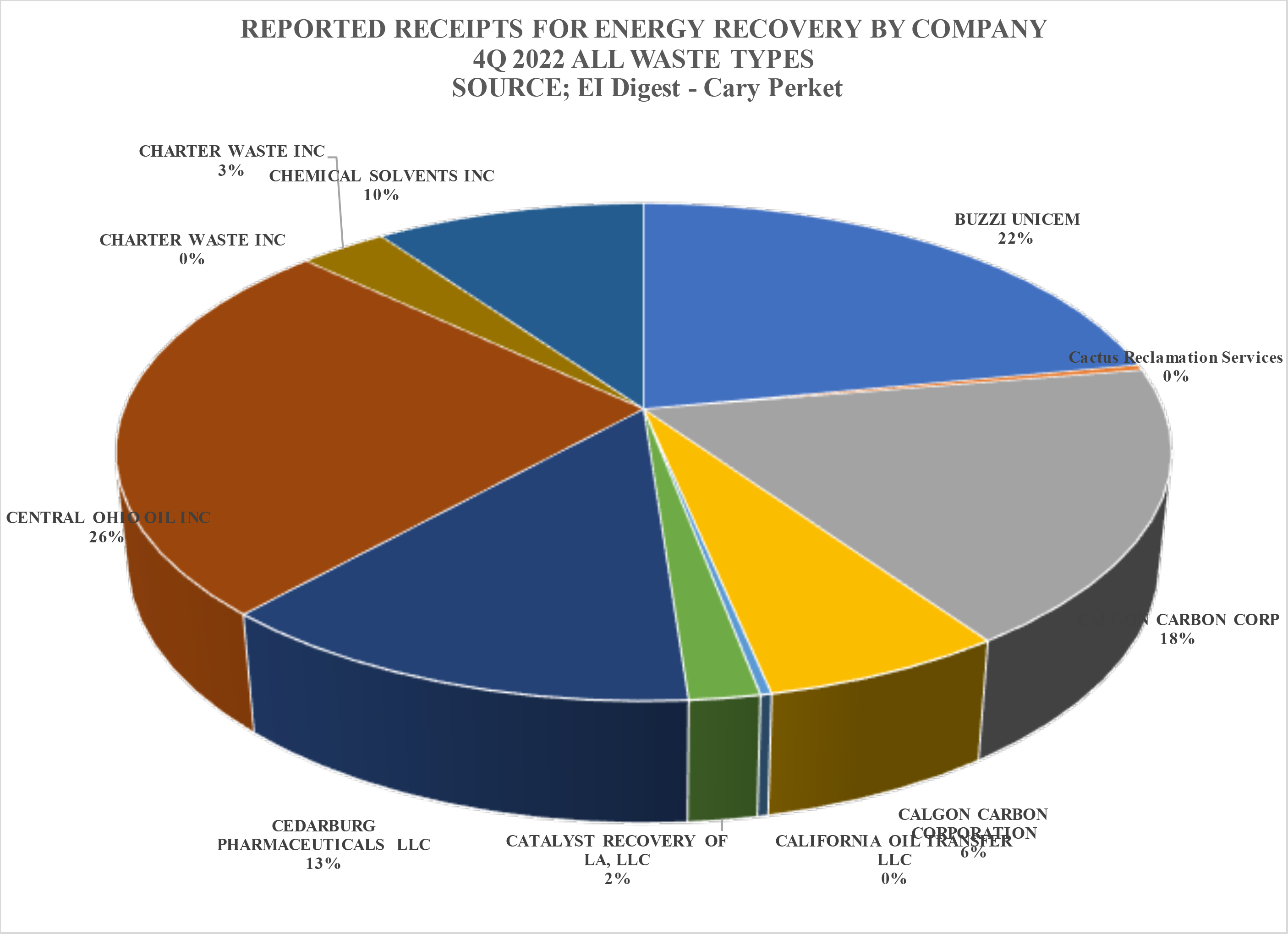

Each new EI Digest Quarterly identifies which company is the leader in report receipts for energy recovery in the most recent quarter. The report provides the current percentage of national receipts of all the companies identifying the leading companies.

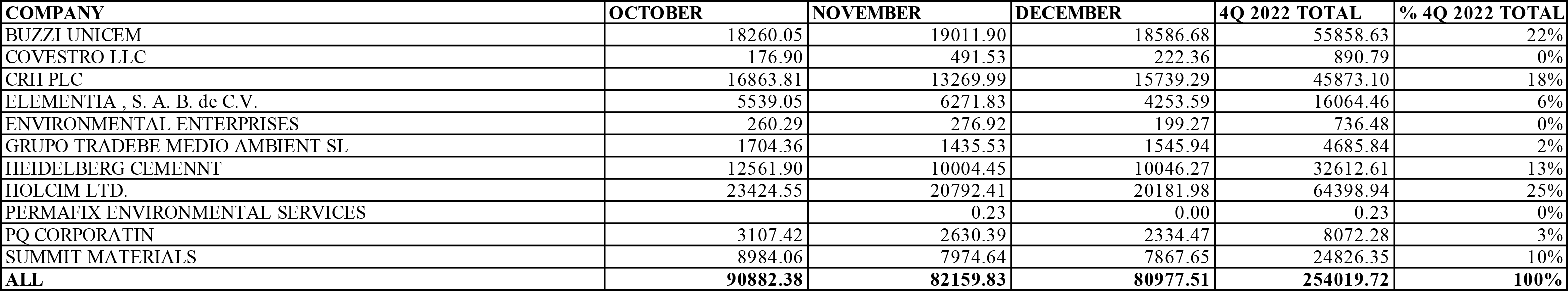

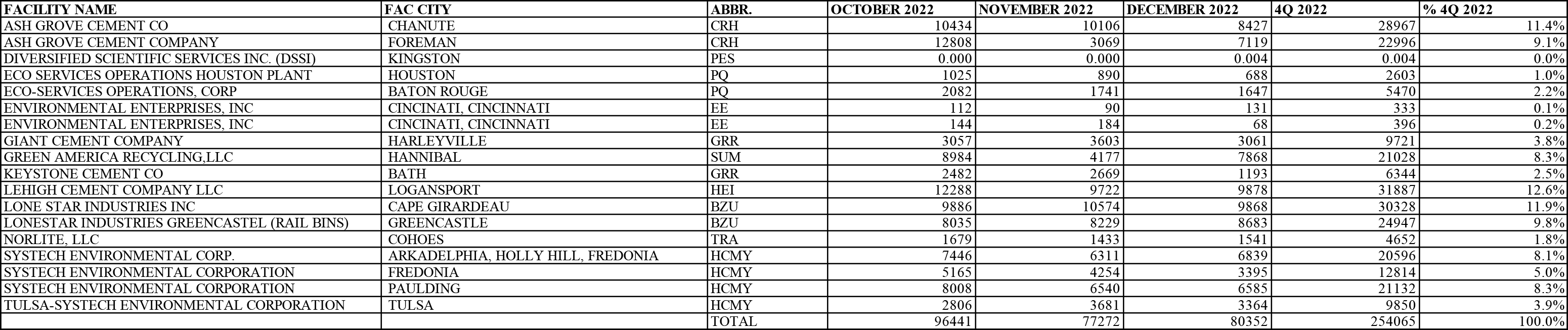

The EI Digest further provides each company’s monthly total receipts and quarterly receipts for each company. The monthly receipts provide insight as to whether any company reported disruptions or surges in their monthly receipts that impacted their total quarterly receipts.

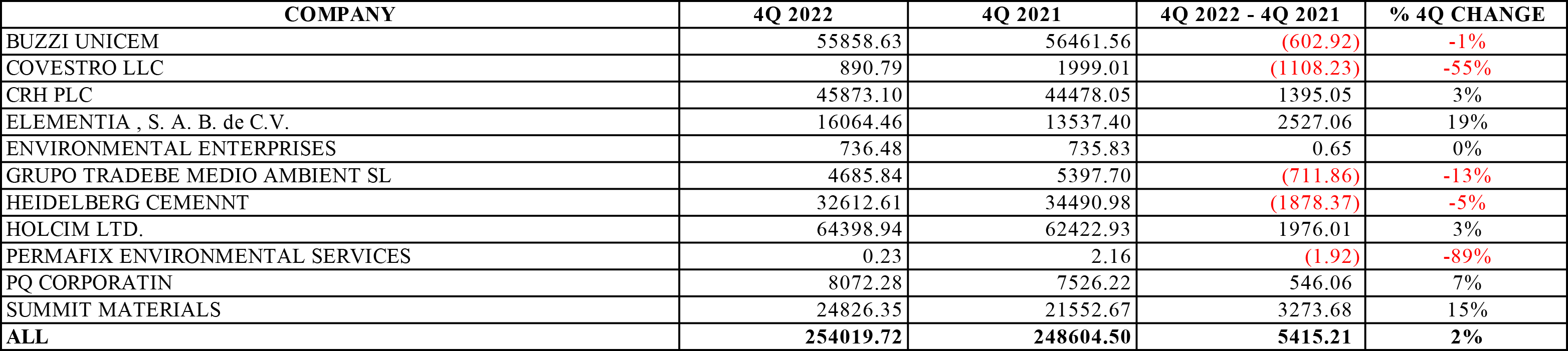

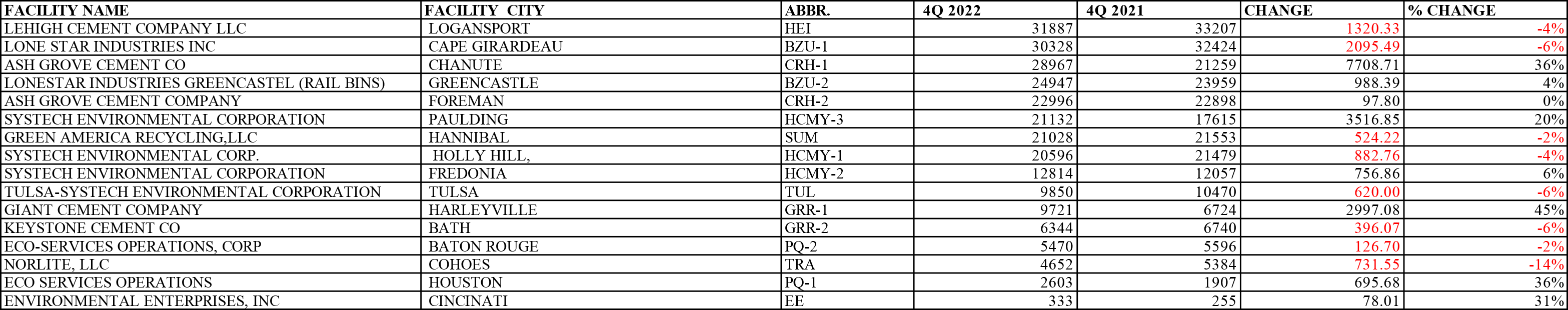

Utilizing its reliable database of previous years of company reporting. EI Digest provides a perspective of how the most recent quarter of company waste receipts compared to the same quarter in the previous year. Investors, market strategists, sales managers, and other stakeholders can utilize the quarter-to-quarter comparison of the individual companies to discern whether each company’s performance is typical or atypical of past company receipts.

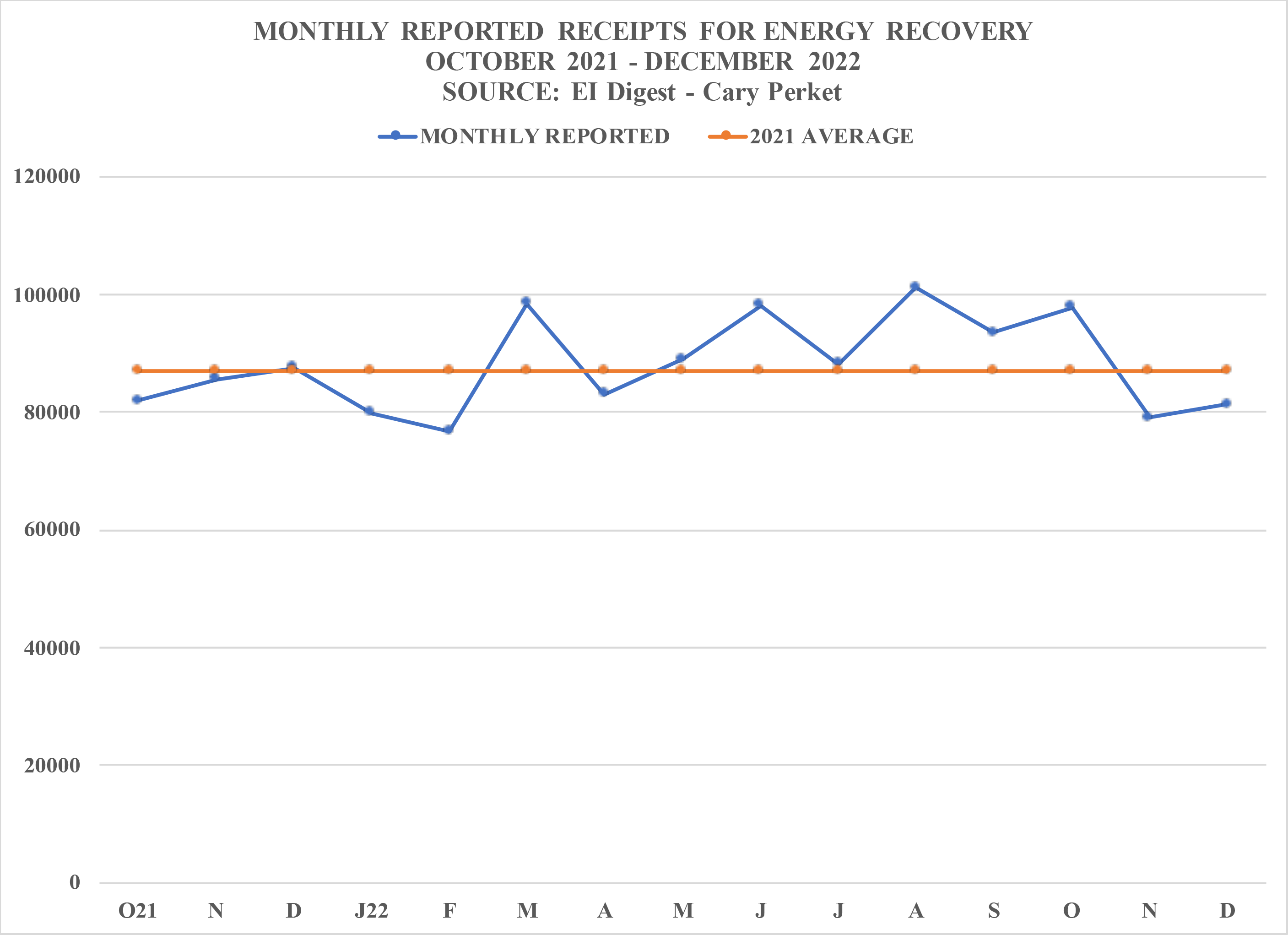

Each EI Digest provides a 15-month history of the total monthly receipts for hazardous waste landfills to keep clients aware of any seasonal decreases and/or decreases. This knowledge of recent past market behavior helps enables investors, market analysts, sales managers, and stakeholders to develop market expectations.

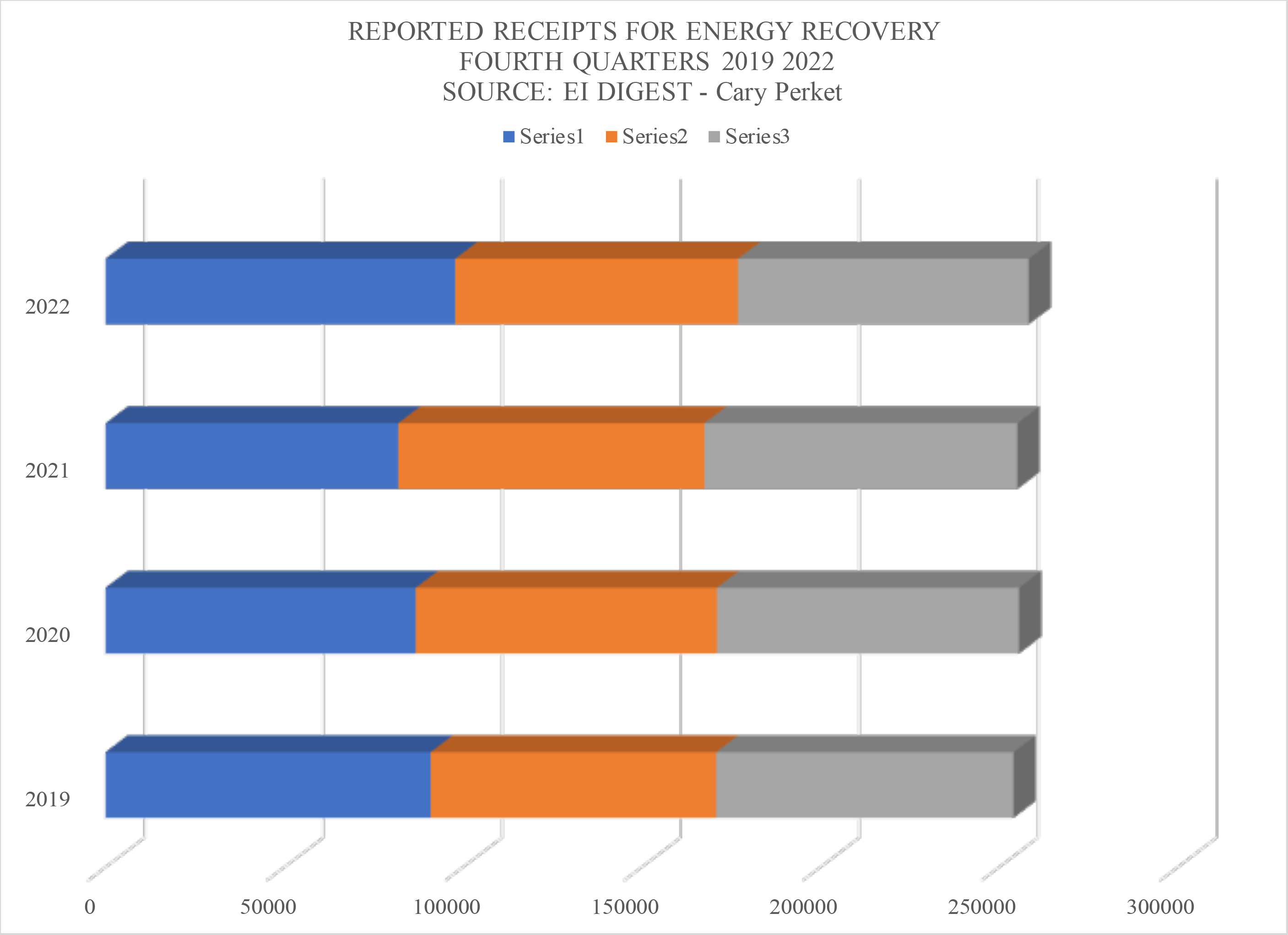

Utilizing its database of reported receipts, each EI Digest provides a comparison of the most recent quarter to past quarterly market performance dating back to 2019. Past market performance provides market strategists, sales managers, and other stakeholders with a historical perspective of fuel usage by hazardous waste boilers and industrial furnaces.

The EI Digest database includes substantial data on each company’s individual facilities. The database enables the EI Digest Quarterly to provide specific facility information providing more detail to the EI Digest company information. This facility information enables sales managers, market analysts, investors, and other stakeholders to track the impact of market disruptions and events on individual facilities to the facilities and parent company market share.

Each EI Digest Quarterly Landfill Report provides the most recently reported three months receipts for all energy recovery facilities. The monthly reporting is compiled into the quarterly total for each facility and the facility market share for the quarter. The quarterly summaries tabulations are often very meaningful to market analysts who are tracking the receipts at individual facilities as a harbinger of the company’s overall performance.

The investment in the Digest database enables the EI Digest to compare the most recent quarterly receipts for each BIF facility to the previous year. This comparison is particularly useful in helping analysts, investors, and market strategists determine the extent to which individual BIF facilities are experiencing decreases and increases in the national marketplace. The proportion of individual facilities reporting increases and decreases is an important indicator of market conditions.

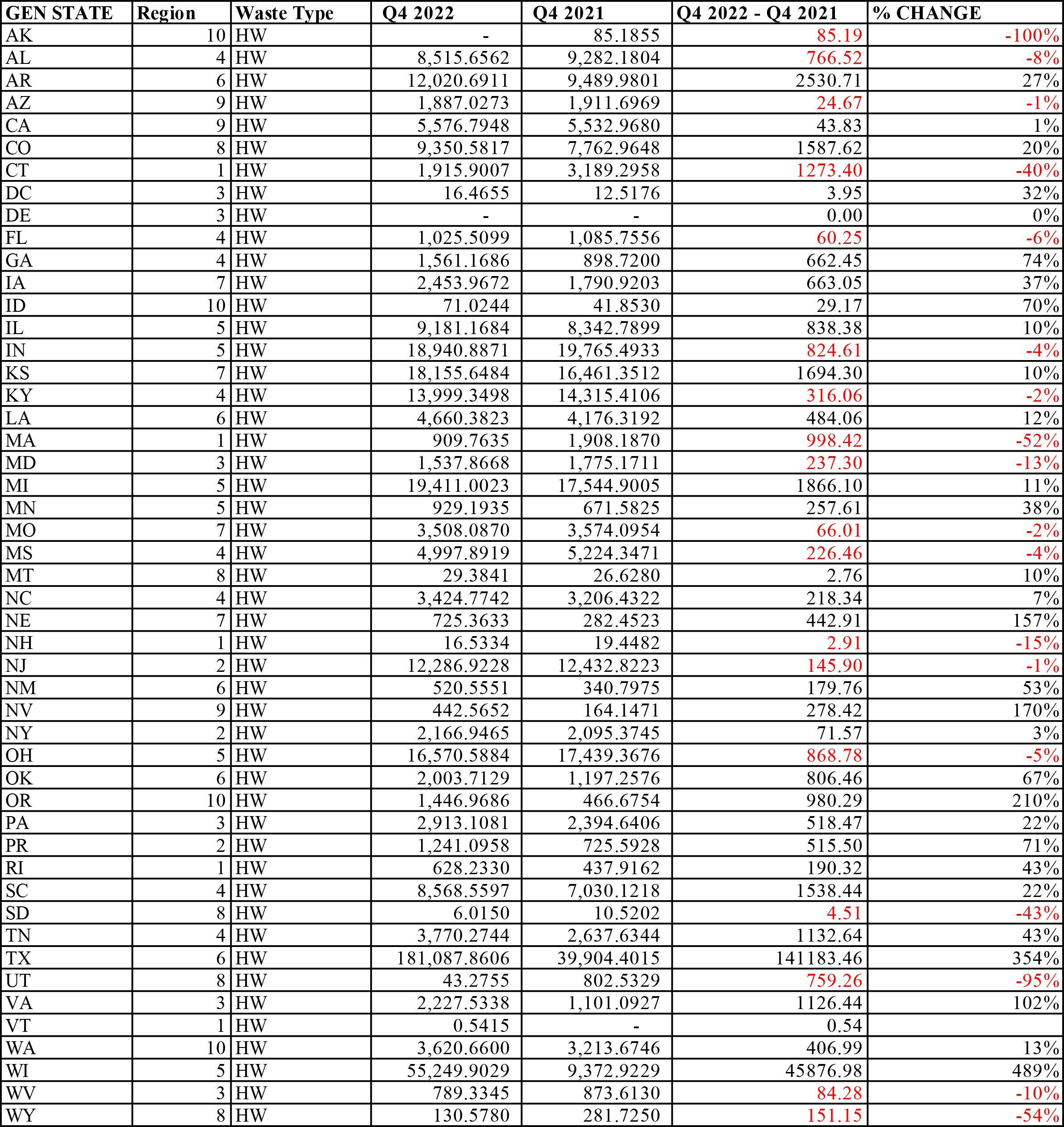

The EI Digest Quarterly final table is a comparison of the reported energy recovery quarterly receipts originating from each state. The table provides the receipts from the state in the most current quarter and the receipts from a year earlier from each state. This tabulation enables us to determine the extent of changes happening in individual states and surrounding regions. They enable a market analysis to determine whether changes at individual BIF facilities are being catalyzed by state market changes.

Energy Recovery worksheet I – facility (optional) enables the client to pursue a more in-depth, custom analysis of the market.

The Microsoft Excel worksheet is designed to enable sorting and summation for individual facilities, groups of facilities, and/or companies.

A key feature is the amount of RCRA hazardous and non-hazardous are itemized.

Energy Recovery worksheet II – state provides the amount of each waste type reported received by each facility.

The worksheet empowers the user to examine which facilities (& companies) are receiving waste from each state. It further enables the user to examine current market share based on the most recent quarter and to examine changes in market share over the same quarter in the previous year.