Hazardous Waste Incineration Market Data, Compilation, & Analysis

EI Digest Quarterly – Hazardous Waste Incineration Report

Overview

The EI Digest Quarterly - Incineration Report provides an in-depth analysis of the United States commercial hazardous waste incineration sector, comparing the current quarter to previous years. This comprehensive report offers valuable insights for industry professionals, researchers, and decision-makers seeking a thorough understanding of industry trends and patterns.

The report presents a detailed examination of the reported receipts, including both hazardous and non-hazardous waste, during the specified quarter. Through carefully curated figures and tables, it showcases the seasonal variations and historical patterns that have characterized the industry since 2019. The report also offers an overview of individual facilities reporting hazardous and non-hazardous waste receipts for incineration. Noteworthy events, such as facility shutdowns, are discussed, shedding light on their implications for the sector.

Authored by Cary Perket Sr., an industry expert, this report offers an authoritative perspective on the current state and future projections of the hazardous waste incineration sector. Its comprehensive analysis serves as a valuable resource for industry stakeholders, enabling informed decision-making and strategic planning.

The EI Digest Quarterly - Incineration Report is an essential asset for professionals seeking a comprehensive understanding of the United States commercial hazardous waste incineration sector. It is a must-have publication for those aiming to stay abreast of industry developments and make well-informed decisions.

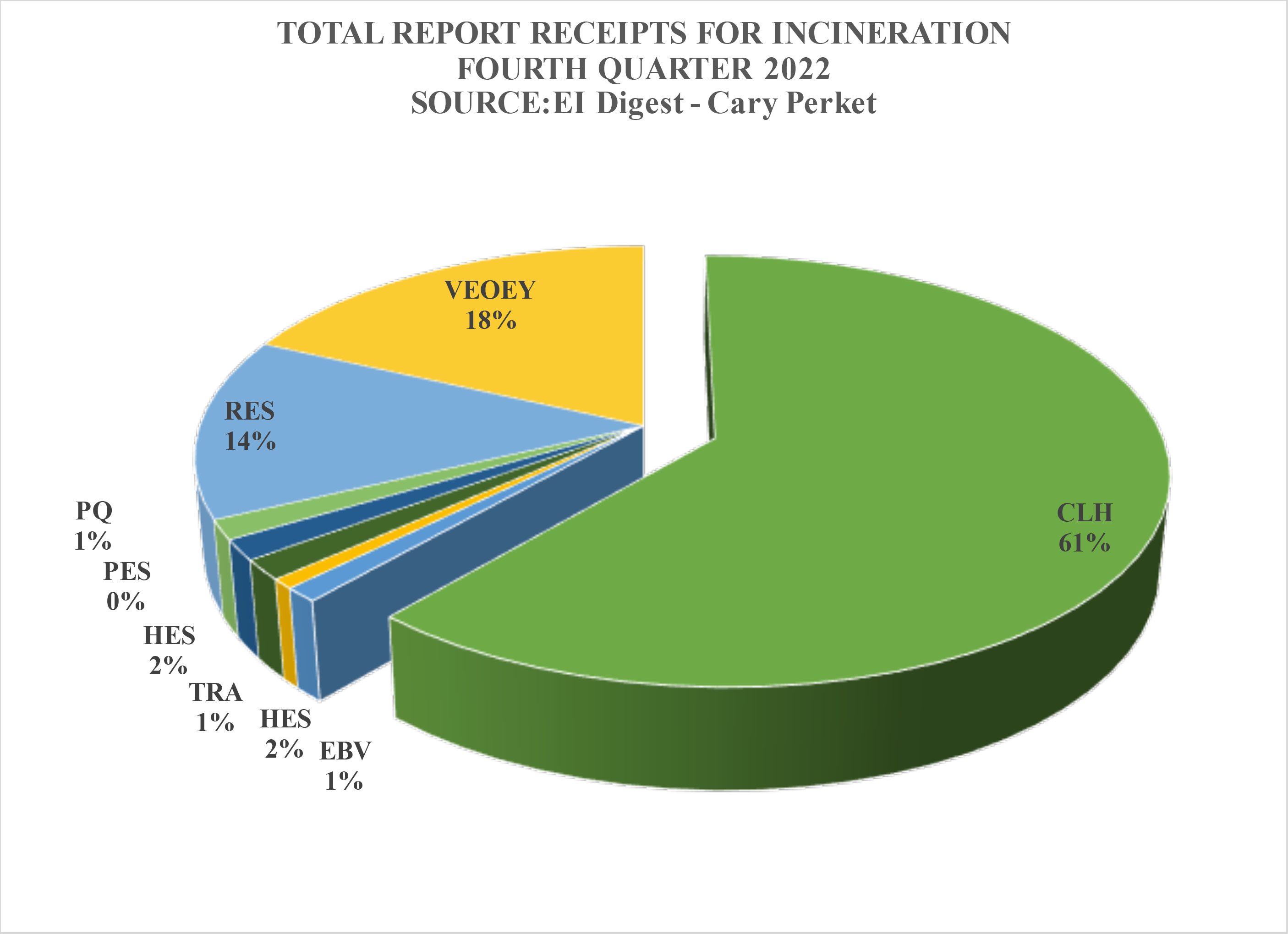

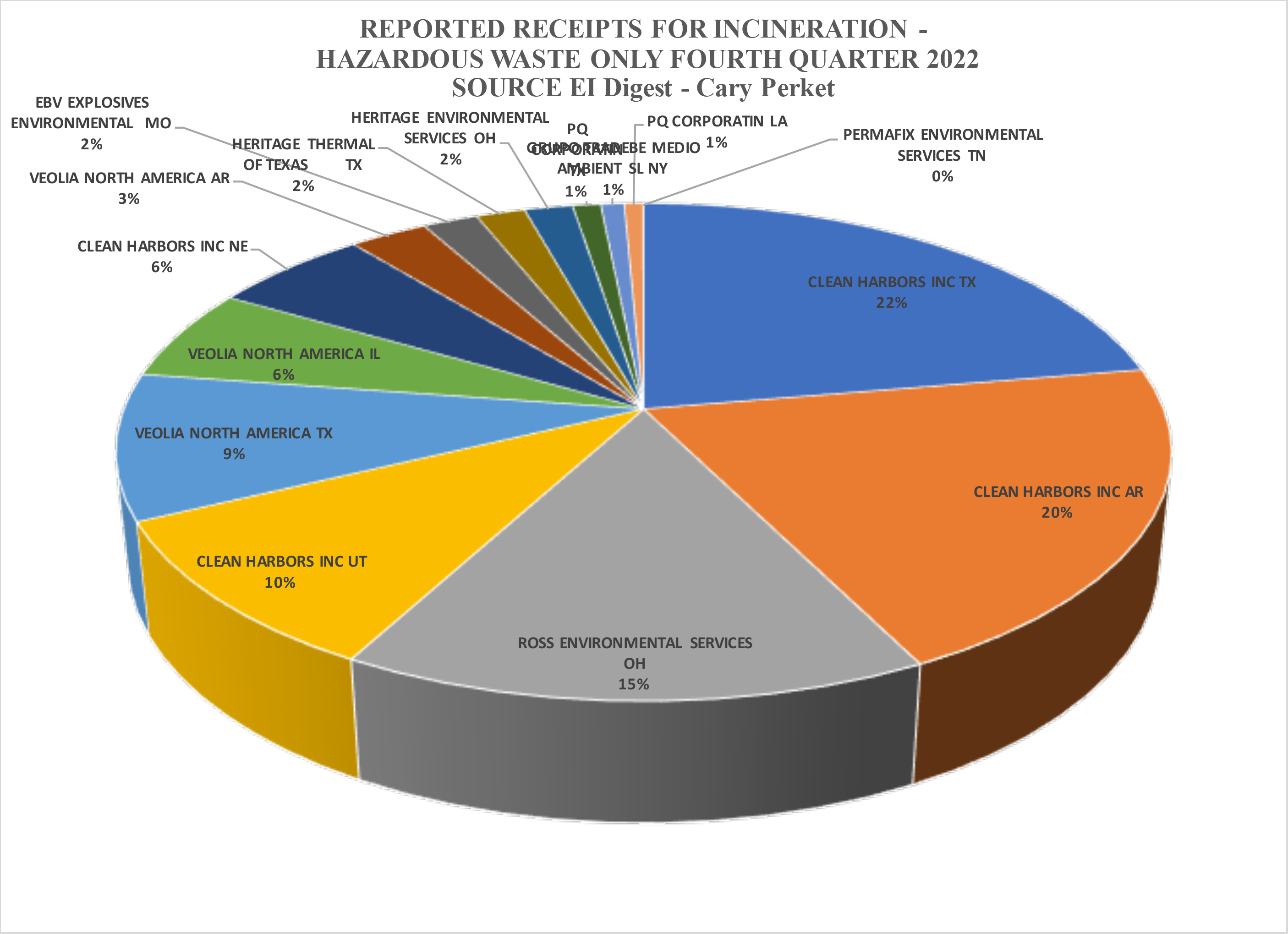

EI digest covers all companies providing RCRA commercial hazardous waste incineration in the United States. RCRA hazardous waste incineration, USEPA management method code h040, is provided by 9 different companies in the United States: clean harbors environmental services, Ebv Explosives Environmental, Grupo Tradebe Medio Ambient SL, Heritage Environmental Services, Heritage Thermal of Orange, Perma-Fix Environmental Services, and Veolia North America.

Each new EI Digest report provides the most current percentage of nationwide incineration done by each company. Investors, market strategists, sales managers, procurement departments, and others as to significant decreases or increases in recent market activity by each company.

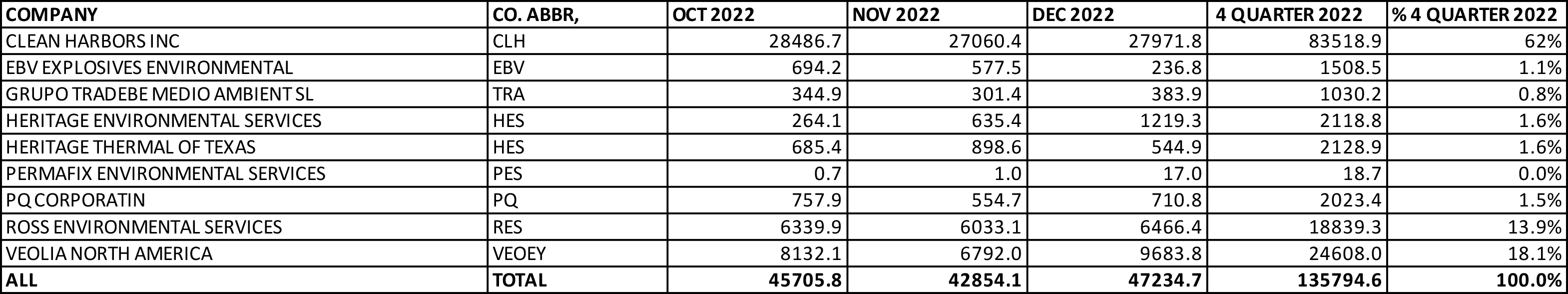

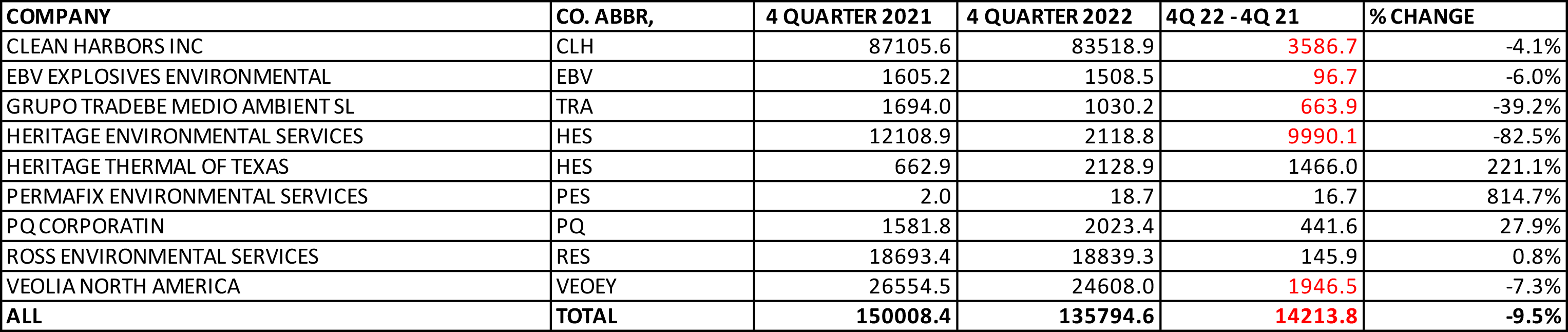

The EI Digest collects, diligently compiles, and organizes the amount of waste received by all ___ companies into monthly and quarterly tables that enable comparisons. Investors, market strategists, sales managers, and other stakeholders can easily assess recent individual and overall market positions. Utilizing its substantial database of previous years of company reporting.

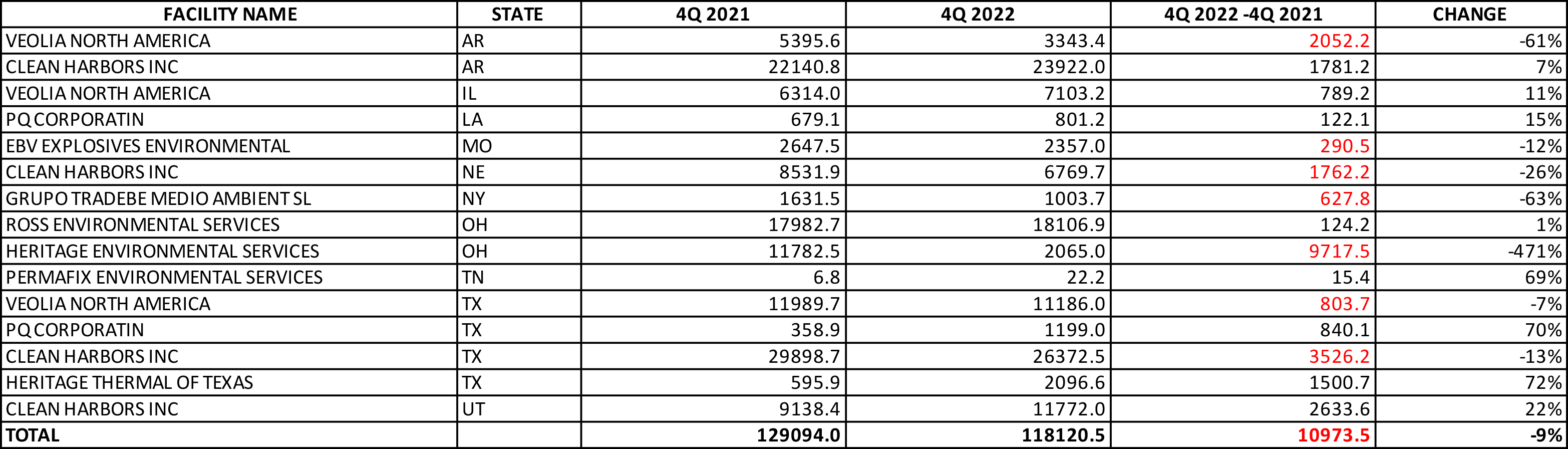

The EI Digest provides a perspective of how the most recent quarter of company waste receipts compared to the same quarter in the previous year. Investors, market strategists, sales managers, and other stakeholders can utilize the quarter-to-quarter comparison of the companies to discern whether the overall market is changing or remaining constant.

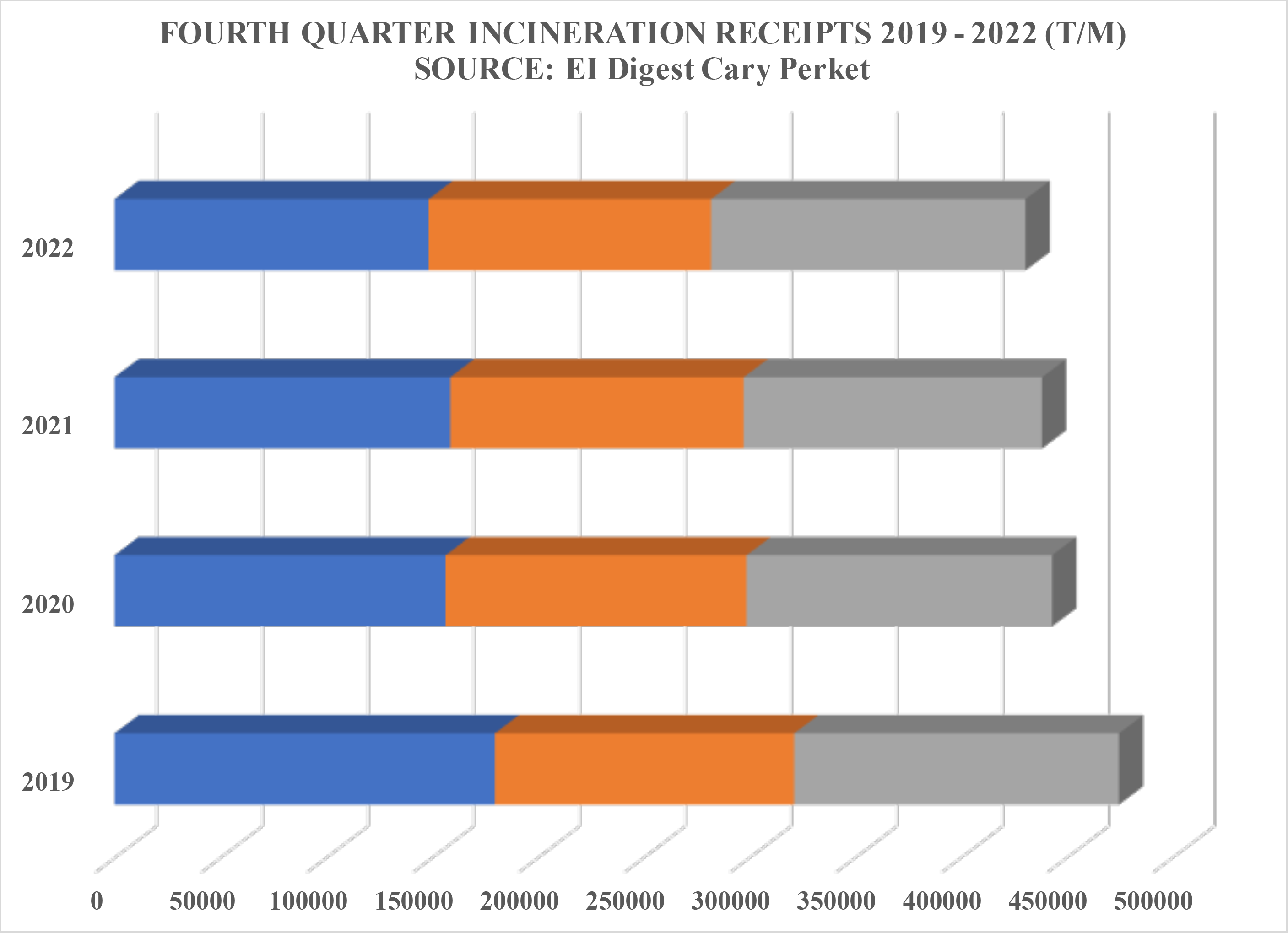

Each EI Digest provides a 15-month history of the overall receipts for hazardous waste incineration to keep clients aware of any seasonal decreases and/or decreases that might be expected based on recent past market behavior. Investors and stakeholders can use this knowledge to develop market expectations.

Utilizing its substantial database of past years, each EI Digest provides a comparison of the most recent quarter to multiple years of past market performance. Past market performance provides market strategists, sales managers, and other stakeholders with historical perspectives, such as the impact of the covid 19 pandemic in 2020.

Ei database includes substantial data on each company’s individual facilities. The database enables the EI Digest quarterly to provide specific facility information comparable in scope to the EI Digest company information. This facility information enables stakeholders and strategists to track the impact of market disruptions and events on individual facilities, such as their market share.

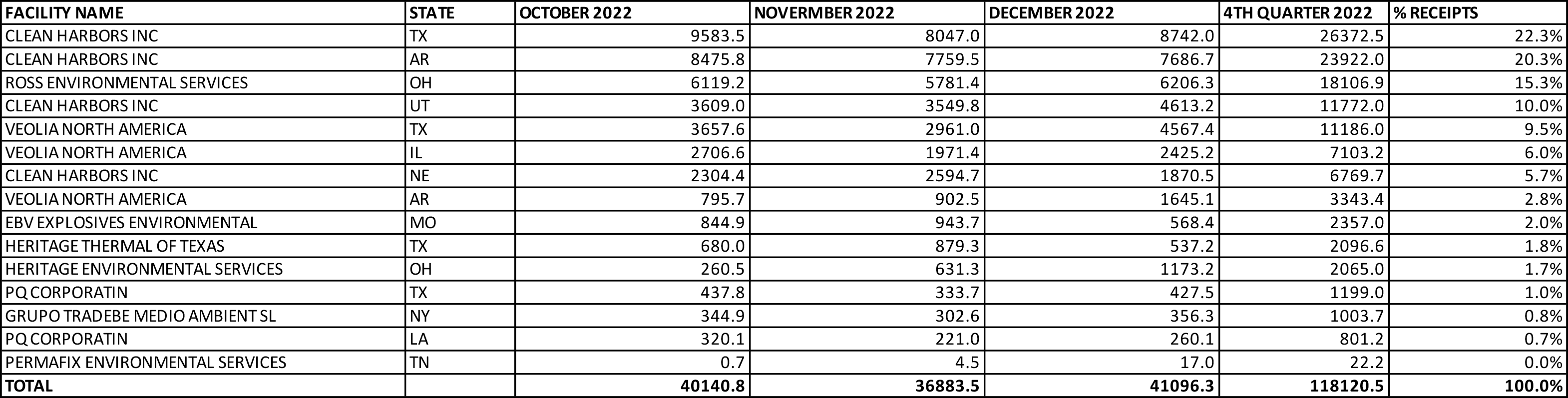

Each EI Digest quarterly report provides the most recently reported three months’ receipts for 15 commercial incineration facilities. The monthly reporting is compiled into the quarterly total and the facility market share for the quarter.

The EI database enables the EI Digest to provide comparing the most recent quarterly receipts for each facility to the previous year. This comparison is useful in helping analysts, investors, and market strategists determine the extent to which individual facilities are reporting decreases and increases in the marketplace.

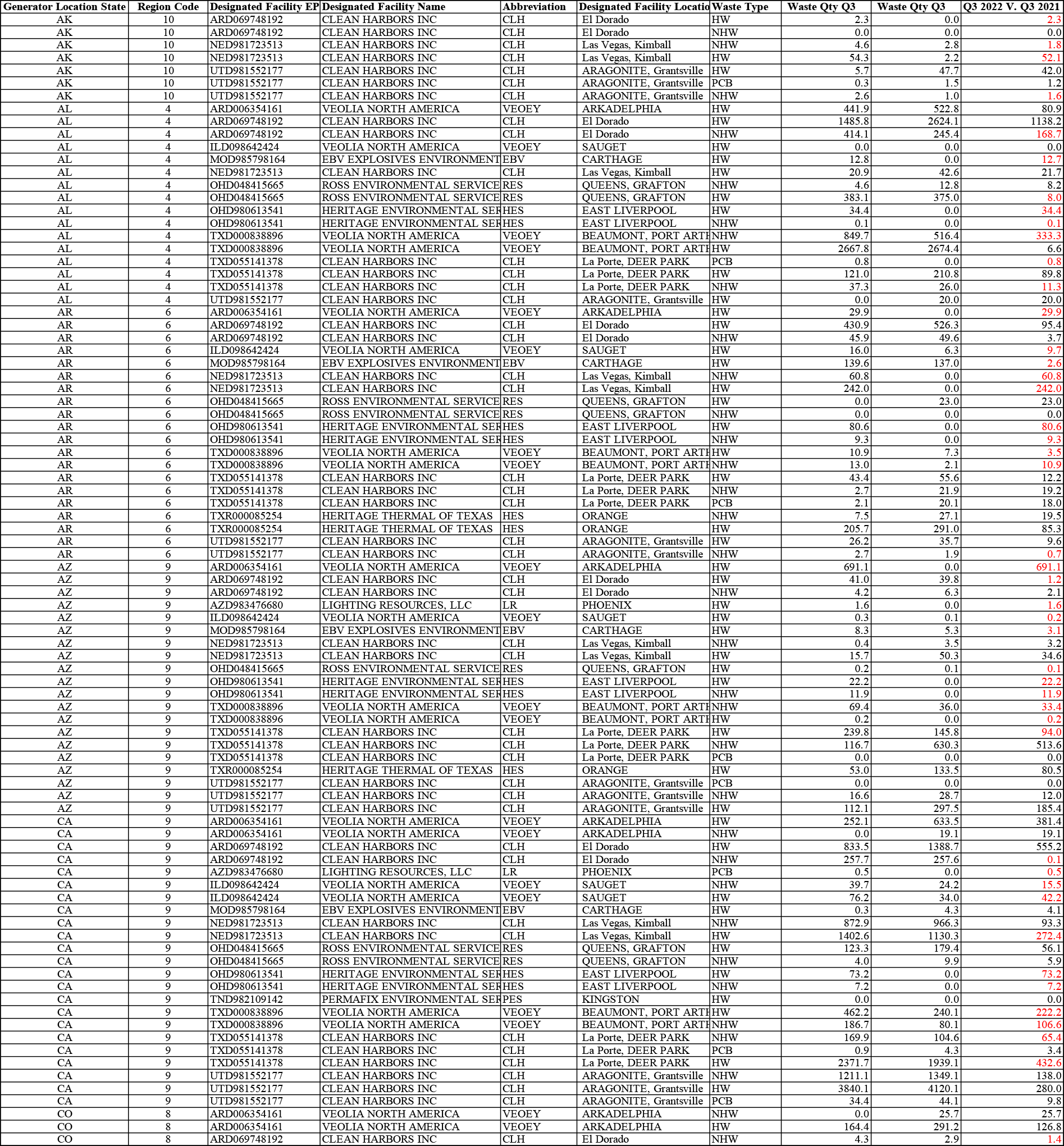

The EI digest quarterly reports provide a macro view of the geography of market changes by providing a comparison of the reported quarterly receipts from each state between the most current quarter and a year earlier. This compilation enables interested parties to determine the extent of changes happening at the state level. Obviously, extensive decreases or decreases amongst the states would be an indicator of major market change occurring.

Incineration worksheet I – facility (optional) enables clients to pursue more in-depth, custom analysis of the market.

The Microsoft Excel worksheet is designed to enable sorting and summation for individual facilities, groups of facilities, and/or companies. A key feature is the amount of RCRA hazardous and non-hazardous are itemized.

Incineration worksheet II – state provides the amount of each waste type reported received by each facility.

The worksheet empowers the user to examine which facilities (& companies) are receiving waste from each state. It further enables the user to examine current market share based on the most recent quarter and to examine changes in market share over the same quarter in the previous year.