Hazardous Waste Stabilization Market Data, Compilation, & Analysis

EI Digest Quarterly – Hazardous Waste Stabilization Report

Overview

The EI Digest, Quarterly Stabilization Report, is a comprehensive and authoritative publication designed to provide stakeholders in the hazardous waste management industry with valuable insights and analyses. This professionally curated report, available for purchase every quarter, offers a detailed examination of commercial hazardous waste stabilization in the United States. Focusing on the treatment of hazardous waste to render it non-hazardous, the report presents the latest figures, tables, and trends in the industry.

It compares data from the current quarter to previous years, enabling stakeholders to identify patterns, track changes, and gain a deeper understanding of the market dynamics. The report includes a range of figures and tables that provide visual representations of the data, facilitating easy comprehension and interpretation. These graphical elements illustrate reported receipts for stabilization on a monthly, quarterly, and fifteen-month basis, allowing stakeholders to analyze short-term and long-term trends.

Additionally, the report highlights significant hazardous waste stabilization facilities and their reported receipts for the quarter, aiding stakeholders in identifying key players in the industry. The EI Digest, Quarterly Stabilization Report, offers expert perspectives from industry professionals, providing valuable context and insights into market opportunities and emerging trends.

These perspectives contribute to the report's overall authority and make it an essential resource for stakeholders seeking to make informed decisions and stay ahead in a dynamic and rapidly evolving industry. With its rigorous research, comprehensive data analysis, and commitment to excellence, the EI Digest Quarterly Stabilization Report serves as a trusted resource for stakeholders involved in hazardous waste management. By providing up-to-date information and strategic perspectives, this report empowers stakeholders to navigate the complexities of the market, capitalize on emerging opportunities, and drive sustainable growth in their organizations.

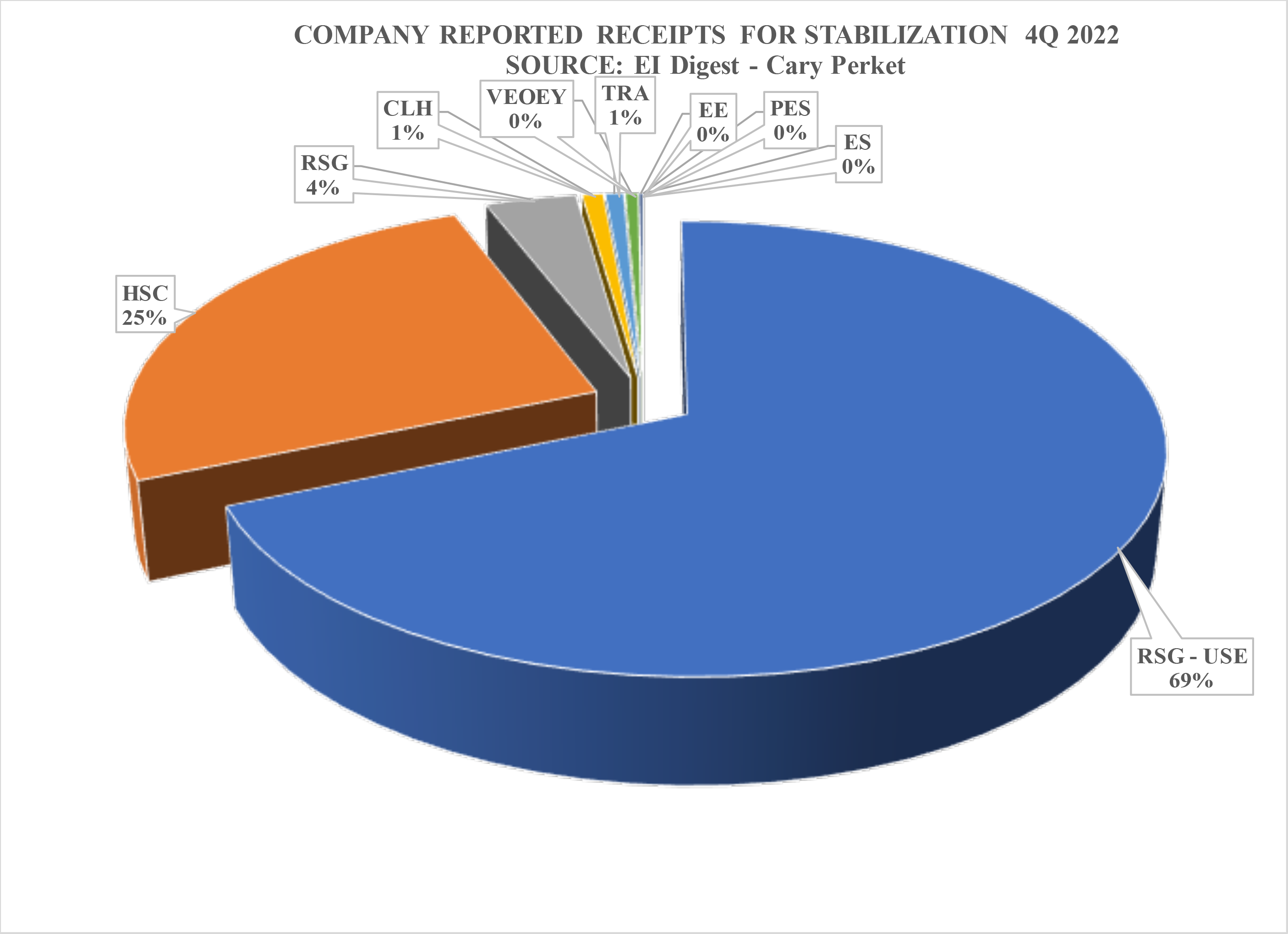

EI DIGEST provides comprehensive coverage of all 8 companies engaged in commercial stabilization services in the United States RCRA Hazardous Waste Stabilization, USEPA management method code H110, is provided by 8 different companies in the United States. Veolia North America, Harsco Corporation, Grupo Tradebe Medio Ambient SL, Environmental Enterprise, Clean Harbors Environmental Services, Perma-Fix Environmental Services, Republic Services. US Ecology, which operates multiple stabilization facilities, has been acquired by Republic Services.

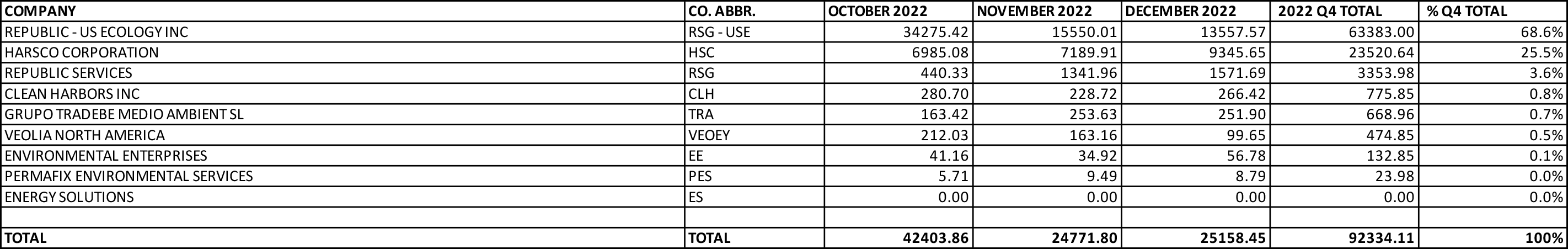

Each EI Digest Quarterly – Stabilization Report compiles the latest receipts for all 8 companies and their respective facilities. The compiles receipts inform sales managers, strategists, and stakeholders as to how the market leaders did in the most current quarter. The stabilization market has the potential for significant quarterly changes due to the periodic acceptance of event-generated wastes.

All 8 companies’ monthly and quarterly receipts are presented in a table that enables company investors, market strategists, sales managers, and other stakeholders to examine their market shares. The monthly statistics enable anyone to determine if any company has experienced a decrease or increase that changed their ranking.

Each EI Digest provides how the most recent quarter of company waste receipts compared to the same quarter in the previous year. Investors, market strategists, and other stakeholders can utilize the quarter-to-quarter comparison of each company’s reported receipts to examine each company’s performance compared to its competitors. The comparison is useful in tracking waste receipts before and after acquisitions and mergers.

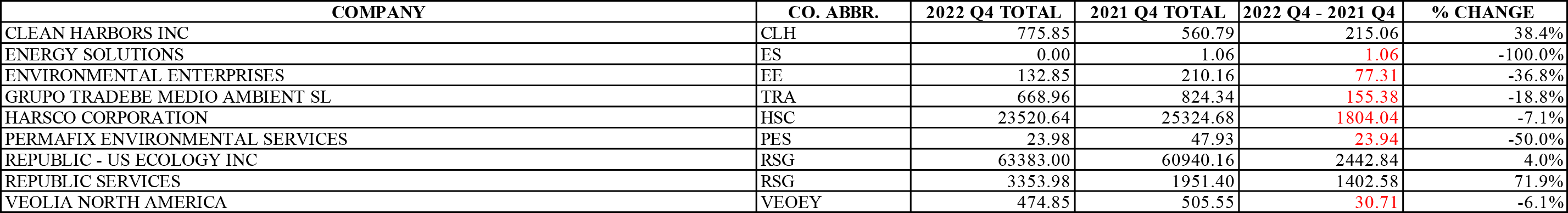

The recent 15-month national history of waste received by Stabilization is provided with each EI Digest. The national 15-month history adds perspective to the comparison provided in Table 2.

The 15-month history enables sales managers, market strategists, and stakeholders to adjust their expectations based on past seasonal market changes.

The longer-term history of the fuel blending sector is illustrated with a comparison of the most recent quarter and previous quarters dating back to 2019. This comparison provides sales managers, market strategists, and stakeholders with perspectives that are useful in developing market expectations.

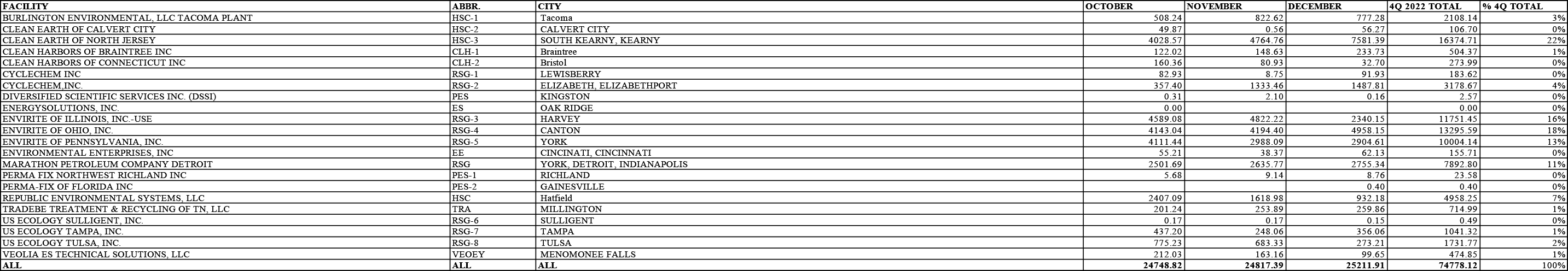

Each EI Digest includes the reported receipts of all 8 company’s individual facilities.

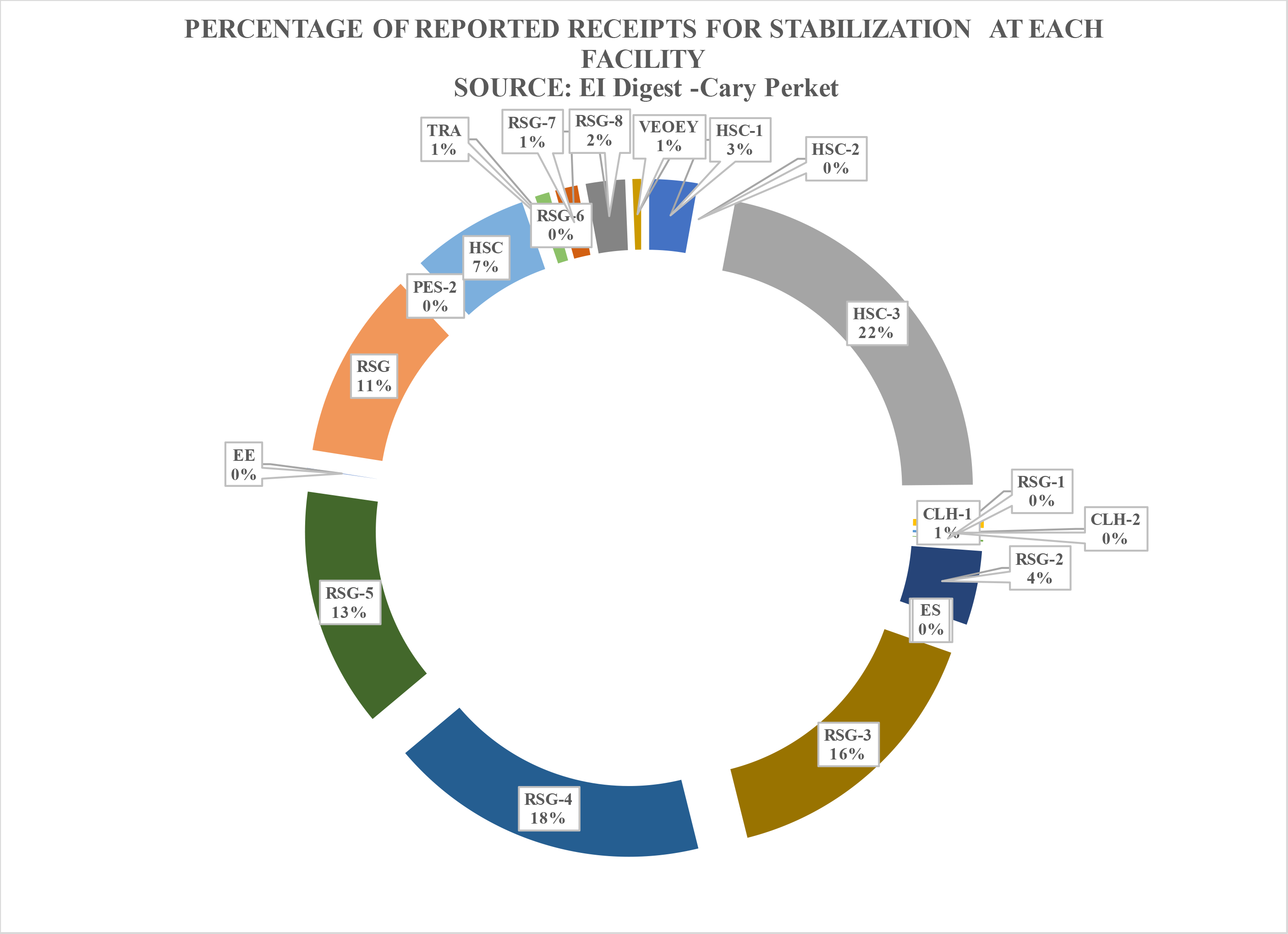

The largest fuel blending facilities are included in a pie chart that enables decision-makers, company management, investors, and stakeholders to quickly determine the leading Stabilization facility’s market share in the most recent quarter.

Each EI Digest Quarterly – Stabilization Report provides a table with the most recently reported three months’ receipts for all 23 individual fuel blending facilities.

The monthly reporting is compiled into a quarterly total that is utilized to rank each facility’s recent quarterly receipts based on national market share for the quarter and the facilities with the most reported receipts included in the facility pie chart.

Each EI Digest Quarterly provides a comparison of each facility’s most recent quarterly receipts to the previous year. This year-to-year comparison of quarterly is particularly useful in helping analysts, company executives, investors, and market strategists assess market direction.

The proportional number of facilities reporting increases compared to decreases is a basic indicator of market direction.

The Digest quarterly reports enable assessment of state-level market changes by providing the reported quarterly receipts from each state. These tables enable interested parties to determine if significant changes are happening at the state level. Extensive decreases or decreases amongst the states would be an indicator of major market change occurring.

Stabilization worksheet I – facility (optional) enables the client to pursue more in-depth, custom analysis of the market. The Microsoft Excel worksheet is designed to enable sorting and summation for individual facilities, groups of facilities, and/or companies.

A key feature is the amount of RCRA hazardous and non-hazardous are itemized.

Stabilization worksheet II – the state provides the amount of each waste type reported received by each facility. The worksheet empowers the user to examine which facilities (& companies) are receiving waste from each state. It further enables the user to examine current market share based on the most recent quarter and to examine changes in market share over the same quarter in the previous year.

Perkets Elucidations Last but not least, Cary Perket polishes each quarterly report with insight and perspective.

Having been in the hazardous waste management sector for over 30 years, Perket has a significant network of highly experienced hazardous waste management executives that he routinely calls upon for their insight and perspective to supplement his own in crafting Perket’s Elucidations. As the principal researcher of all six EI Digest Quarterly reports, Perket’s knowledge of other sectors provides additional insight and perspective.